Throughout June, the amount of tokenized bitcoin on Ethereum, the bulk of it in WBTC, an unique ERC2 token known as “covered bitcoin,” skyrocketed from 5,200 BTC to 11,682 BTC– currently worth around $108 million– according to btconethereum.com.

Tensions between the Bitcoin and also Ethereum people have been mixed by a pattern that outsiders might view as a sign of harmony.

As is their wont, each intrigue defined the development of WBTC tokens, whose worth is secured one-to-one against a locked-up book of actual bitcoin, as proof of their coin’s superiority over the other. The Ethereum crowd stated it revealed that even BTC “hodlers” think Ethereum-based applications offer a better off-chain transaction experience than systems built on Bitcoin, such as Lightning or Blockstream’s Fluid. Bitcoiners, by comparison, took it as confirmation that people put better worth in the oldest, most useful crypto property, than in Ethereum’s ether token.

Under the competition on Crypto Twitter, the bitcoin-on-Ethereum trend states extra regarding complementarity than competition.

The information all at once highlight that bitcoin is the crypto world’s reserve property and that Ethereum’s burgeoning “DeFi” community is crypto’s best platform for producing credit rating and promoting fluid exchange.

Real world parallels

Though it’s prematurely to understand who the eventual winners will certainly be, I believe this pattern catches the very early beginnings of a new, decentralized worldwide monetary system. So, to explain it, an analogy for the existing one serves: bitcoin is the buck, and also Ethereum is SWIFT, the global network that collaborates cross-border settlements among banks. (Given that Ethereum is trying to do far more than repayments, we might also cite a number of various other organizations in this example, such as the International Swaps as well as Derivatives Organization (ISDA) or the Depository Depend On and Clearing Up Corporation (DTCC).).

So, allow’s disregard insurance claims like those of Ethhub.io co-founder Anthony Sassano. He said that due to the fact that bitcoin token transactions on Ethereum deny miners fees they would certainly or else receive on the bitcoin chain, bitcoin is coming to be a “second-class citizen” to ether. You ‘d hardly expect individuals in countries where dollars are liked to the neighborhood currency to think about the previous as second course. And just as the united state gain from abroad demand for bucks– via seignorage or interest-free loans– bitcoin owners gain from its popular liquidity and security value in the Ethereum ecological community, where it lets them remove premium interest.

Still, to declare bitcoin the champion based on its appeal as a book asset is to compare apples to oranges. Ether is increasingly checked out not as a repayment or store-of-value money but for what it was meant: as an asset that fuels the decentralized computer network coordinating its wise agreements.

That network now sustains its monetary system, a decentralized microcosm of the enormous conventional one. It takes tokenized versions of the underlying money that users most worth (whether bitcoin or fiat) as well as gives disintermediated devices for lending or borrowing them or for creating decentralized by-product or insurance policy contracts. What’s arising, albeit in a kind also volatile for typical institutions, is a diverse, market for managing and also trading in danger.

This system is being sustained by a global advancement and also advancement pool larger than Bitcoin’s. Since June last year, there were 1,243 permanent programmers servicing Ethereum compared to 319 servicing Bitcoin Core, according to a report by Electric Resources. While that job is spread across several projects, the size of its community gives Ethereum the advantage of network impacts.

Whether DeFi can lose its Wild West really feel as well as develop completely for mainstream fostering, the code as well as ideas produced by these engineers are laying the structure for whatever controlled or uncontrolled blockchain-based money versions arise in the future.

Complexity vs simpleness.

There are genuine worries regarding protection on Ethereum. With such a complex system, and so several programs working on it, the attack surface is large. As well as offered the challenges the neighborhood deals with in moving to Ethereum 2.0, including a brand-new proof-of-stake consensus mechanism and a sharding remedy for scaling deals, it’s still not assured it will ever await prime-time show.

Indeed, the family member absence of complexity is one reason lots of feel more comfortable with Bitcoin Core’s security. Bitcoin is a one-trick pony, yet it does that technique– keeping track of unspent deal outcomes, or UTXOs– very well as well as really safely. Its proven safety and security is a crucial reason bitcoin is crypto’s reserve possession.

Base-layer safety is additionally why some designers are constructing “Layer 2” wise contract protocols on Bitcoin. It’s tougher to improve than Ethereum, yet services are progressing– one from Rootstock, for example, as well as extra just recently, from RGB.

And also while Ethereum followers crow about there being 12 times a lot more covered bitcoin on their platform than the mere $9 million secured the Lightning Network’s payment channels, the last is making invasions in developing countries as a settlement network for little, low-priced bitcoin transactions. Unlike WBTC, which needs a professional custodian to hold the original locked bitcoin, Lightning individuals need not count on a 3rd party to open a network. It’s arguably more decentralized.

Toward anti-fragility.

At the same time, the addition of bitcoin in Ethereum smart agreements is inherently strengthening the DeFi system.

Decentralized exchanges (DEXs), which permit peer-to-peer crypto trading without central exchange (CEX) taking wardship of your assets, have incorporated WBTC into their markets to boost the liquidity needed to make them feasible. Certainly, DEX trading quantities jumped 70% to tape highs in June. (It helped, as well, that June saw a rise in “yield farming” operations, a difficult brand-new DeFi speculative task that’s simpler to do if you preserve control of your properties while trading.).

MakerDAO team photo (Twitter).

Meanwhile, the current relocation by leading DeFi system MakerDAO to include WBTC in its approved security has meant it has a bigger swimming pool of value to generate finances versus.

This development in DeFi’s user base and also market offerings is in itself an increase to safety. That’s not even if even more developers indicates even more code vulnerabilities are uncovered and also repaired. It’s because the combinations of capitalists’ brief as well as long placements, and also of insurance coverage as well as acquired items, will eventually get closer to Nassim Taleb’s suitable of an “antifragile” system.

That’s not to say there aren’t risks in DeFi. Many are worried that the frenzy around speculative tasks such as “return farming” as well as interconnected leverage could trigger a systemic situation. If that happens, perhaps Bitcoin can provide an alternative, even more stable architecture for it. In either case, suggestions to improve DeFi are coming regularly– whether for far better system-wide data or for a more reliable lawful structure. Out of this hurly burly, something transformative will emerge. Whether it’s dominated by Ethereum or spread across various blockchains, completion result will reveal more cross-protocol harmony than the chains’ warring communities would suggest.

Gold “To The Moon”.

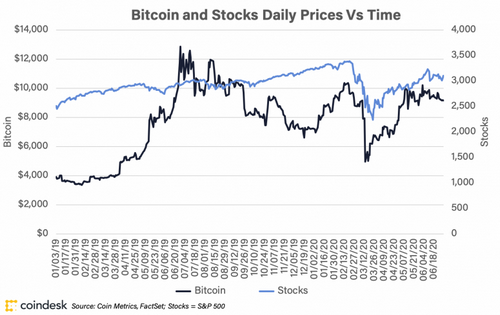

Bitcoin may be a reserve possession for the crypto community yet its recent cost trajectory, with gains and also losses tracking equities, suggest the non-crypto “normies” don’t (yet) see it in this way. Offered the COVID-19 crisis’s extreme examination of the global monetary system and central banks’ huge “measurable easing” response to it, that rate efficiency presents a challenge to those of us that see bitcoin’s core usage instance as an internet age bush versus centralized monetary instability. Much from abiding by that “electronic gold” story, bitcoin has done like any other “risk-off” property.

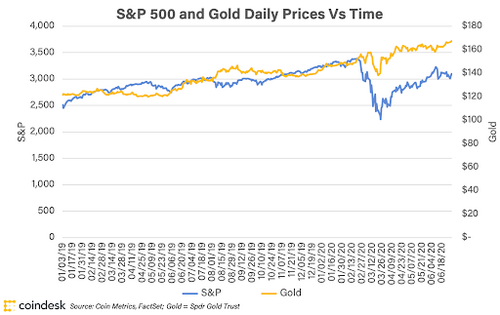

Meanwhile, real gold has actually gotten rid of its own early-crisis stock market relationship to chart a higher program. While bitcoin has continuously stopped working to sustainably appear $10,000, bullion has rallied dramatically to close in on $1,800, degrees it hasn’t seen given that September 2012. Some experts are predicting it will breach its all-time intraday high of $1,917, hit in the aftermath of the last global monetary situation in 2011. To add insult to injury, one Forbes contributor also stole from the crypto lexicon to explain the state of play, telling his viewers that gold rates are “rising to the moon.”.

Two graphes below reveal the different lot of money of these two prospective safe houses. Throughout 2019, bitcoin appears much less correlated with the S&P 500 stock index than gold is. Come the collapse in March 2020, they appear to exchange scenarios.

Bitcoin as well as stocks over time (CoinDesk).

S&P as well as gold gradually (CoinDesk).

How to resolve this? Time.

Gold has actually had at the very least 3 millennia to develop itself as a shop of value individuals count on when social systems remain in stress and anxiety. Bitcoin has actually just existed for 11 years as well as while plenty of financiers want to hypothesize on the opportunity that it might replace or compete with gold, the idea is far from implanted throughout culture. When will it be much more widely approved?

Probably when the global dilemma of international management unleashed by COVID-19 undermines the capacity of establishments like the Federal Get to maintain economic and social self-confidence. Whatever new organizations and systems we produce going forward will certainly need to attend to exactly how the web has actually upended culture’s centralized systems of governance. When that happens, we’ll require a decentralized, electronic get asset as the base value layer. As I stated, it will require time. At the same time, the designers will keep structure.

Global City Center.

TRUST ME, BOND MARKET, PLEASE. James Glynn at The Wall Street Journal had a piece today regarding just how the Federal Book is taking into consideration following Australia’s lead in operation “return caps” as a policy tool to maintain long-dated rates of interest down. The thinking is that if the central bank clearly signals it will certainly constantly set up bond-buying if the yield on a benchmark property such as the 10-year Treasury note rises above some predefined ceiling, the market will certainly be less inclined to too soon think the Fed is going to begin tightening financial policy. To put it simply, we won’t see a rerun of the 2013 “Taper Temper tantrum,” when the U.S. bond market, fretting that the Fed would start tapering off its bond-buying, or measurable easing, drove down bond rates, which raised yields. (For bond market newbies, yields, which measure the reliable annual return bondholders will certainly make off a bond’s fixed rate of interest when readjusted for its price, action inversely to price.).

The yield cap plan would be new for the Fed, yet it’s really an extension of an ongoing effort to do one thing: obtain the market to believe its purposes. The method monetary plan works these days, it’s useless unless the marketplace acts according to what the Fed wants. It’s not about what the central bank does per se; it has to do with what it claims as well as whether those words are incorporated right into financier habits. But the even more it doubles down on this, the extra the Fed produces scenarios in which it runs the risk of having its words held versus it. Which puts it in jeopardy of losing its essential currency: the general public’s trust.

Commitments to price targets are constantly especially high-risk– ask Norman Lamont, the UK Chancellor of the Exchequer, that needed to desert the pound’s money secure in 1993 because the marketplace didn’t believe the U.K. would back its promises. The Fed has limitless power to buy bonds, yet whether it constantly has the will to do so will depend upon national politics and other aspects. Once it’s secured right into a commitment, the risks increase. In the meantime, the marketplaces– most significantly, fx markets– still trust the Fed. Yet, as the claiming goes, count on is hard to make, easy to shed.

Zimbabwean banknote (Fedor Selivanov/Shutterstock).

ZIMBABWE MISTAKENLY LEAVES DOOR OPEN FOR CRYPTO. Right here’s a dish for developing an abundant atmosphere for alternate settlement systems: disallow the system that every person is currently utilizing. When the Zimbabwean federal government made the nutty step of banning electronic repayments– used for 85% of transactions by people, as a result of extreme shortage of money– it plainly wasn’t trying to advertise bitcoin. In forcing individuals to head to a local bank to retrieve funds locked in prominent repayments apps such as Ecocash, its goal was to protect the embattled Zimbabwean buck.

In a statement, the Reserve Bank of Zimbabwe, said the relocation was “required by the need to safeguard customers on mobile money platforms which have actually been abused by underhanded and also unpatriotic people as well as entities to produce instability as well as inefficiencies in the economy.” The thinking is that Ecocash, which enables money trading, is making it much easier for individuals to discard the neighborhood money. However below’s the thing: Ecocash, which said it suspended cash-in-cash-out functions (probably because its banking lines will be reduced) is still keeping in-app settlement centers open. As well as it said nothing about stopping its rather preferred service allowing people to buy cryptocurrency. Not remarkably, because the restriction “need for bitcoin has skyrocketed,” according to African crypto information website, bitcoinke, with “sources claiming bitcoin is currently costing at 18% premium over the market price.”.

OF CASH AND ALSO MISCONCEPTIONS. I’m reading Stephanie Kelton’s publication, “The Shortage Myth.” In a future edition of Cash Reimagined, I’ll have more to state on one of the most prominent modern monetary theory proponent’s description of its ideas. However, for now I’ll simply claim that, while I’m not most likely to be a transform to all its prescriptions, it appears clear that MMT is widely misconstrued by people on both the left as well as the right– also, quite by the crypto market. The latter is probably due to the fact that individuals in crypto tend to skew more to the metallist college of cash, instead of to chartalism. In any case, a clearer grasp of what MMT is all about would, I believe, aid boost the market’s conversation around government, cash, trust fund as well as how blockchain-based systems can integrate with the existing one.

Disclosure.

The leader in blockchain news, CoinDesk is a media electrical outlet that strives for the highest possible journalistic standards as well as abides by a rigorous collection of editorial plans. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies as well as blockchain start-ups.