The Bitcoin network is currently at its greatest, with the hash price striking a brand-new all-time high 63 days after the May supply press

Complete computing power on the Bitcoin network has actually struck a brand-new all-time high: clocking 125 EH/s for the first time because the mining benefits were cut by fifty percent in May.

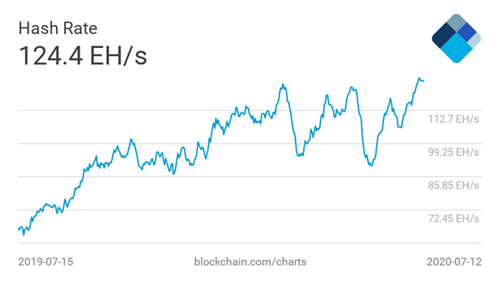

The hash rate worth, whose seven-day moving standard currently stands at 124.4 EH/s, beats the 123.8 EH/s high recorded in the days leading up to the last halving.

With the included hash rate, the biggest cryptocurrency by market cap is perhaps at its best as well as healthiest.

Bitcoin hash rate chart.

Fundamentally, miners have actually activated their mining gears each time when the network’s mining problem has been predicted to change upwards by greater than 9.5%, from 15.78 T to 17.29 T.

No miner capitulation yet

Bitcoin’s hash price hitting brand-new highs provides the concept that the network dealt with an impending ‘death spiral’ unimportant in the meantime. The concept proposes that Bitcoin miners are likely to dump their machines or go on to other networks after the most recent benefits reduced also cut miner income.

Extra pointedly, Bitcoin’s hash price tanked in the days after the halving as Bitcoin Cash and also Bitcoin SV had their computing power spike to new highs.

Although the cost of Bitcoin has actually gone stale below lengthy term resistance at $10k, it shows up FUD regarding miner capitulation is out of the question– in the meantime a minimum of.

The access of new as well as extra efficient mining tools, like Bitmain’s S19 as well as S19 Pro, means miners are adding even more computer power to the network.

Bitcoin’s bulls will be keeping in mind the historical significance of existing network toughness. In the past, especially after the 2012 and 2016 halvenings, prices surged to local highs in the second fifty percent of the year after each occasion.

Bitcoin price goes stale listed below $9,400.

Bitcoin’s rate has stalled around $9,300, with the lack of exercise most likely to proceed for some time as volatility sticks around near to its least expensive considering that the last advancing market.

Especially, nonetheless, the cryptocurrency market typically follows such an extensive stage of loan consolidation with a shock move.

In the short term, BTC/USD is likely to remain in between $9,300 and $9,400, with the cost hitting the lower border of a decreasing triangular if vendors have their method. The location around $9,000 to $8,600 is an essential assistance zone for customers, with any kind of spikes in the temporary likely to be subdued at around $9,400.