However, while gold has a solid track record of rallying in times of stress and anxiety in the international equity markets, bitcoin is yet to develop a similar reputation as a safe-haven possession.

Ever since its inception, bitcoin has actually been dubbed “digital gold,” provided it is durable, fungible, divisible as well as limited like the rare-earth element.

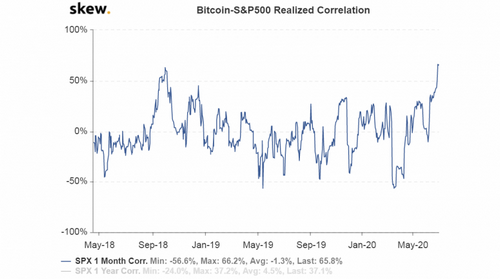

In fact, in current months, the cryptocurrency has been significantly correlated with the S&P 500, Wall Street’s equity index and criteria for global securities market. Now, information suggests that partnership is more powerful than ever, likely denting its charm as electronic gold.

The one-month bitcoin-S & P 500 understood correlation rose to a record high of 66.2% on June 30 as well as stood at 65.8% on Thursday, according to crypto derivatives research study company Skew, which began tracking the information in April 2018.

One-month correlation

” While bitcoin and also S&P 500 correlation is always an excellent sign of market movement, it never truly maintains a regular placement. Bitcoin behaves more like a highly leveraged setting and follows the market fads in a more unpredictable, remarkable up and down swings,” claimed Wayne Chen, chief executive officer and director of Interlapse Technologies, a fintech firm.

The one-month statistics oscillated largely in the range of -30% to 50% for year before rising to tape highs above 60% on June 30. The data without a doubt reveals that bitcoin’s relationship with the S&P 500 is rather irregular.

The 1 year connection has also risen to lifetime highs above 37%, according to Skew. One should keep in mind, however, that readings between 30% to 50% indicate a relatively weak correlation in between variables.

” Bitcoin, by all accounts, is still a danger asset. In spite of those who might proclaim its basic resemblances to gold, it has actually not yet shown to be an adequate hedge or a flight to security in times of risk-off belief,” claimed Matthew Dibb, founder of Stack, a company of cryptocurrency trackers as well as index funds.

Danger properties are the those with ton of money connected to the state of the worldwide economy. For instance, rates of stocks as well as commercial steels like copper have a tendency to rise when the international economic growth rate is expected to pick up pace as well as fail during a financial downturn.

Bitcoin has basically behaved like a risk asset this year. The cryptocurrency’s cost fell from $10,000 to $3,867 in the initial fifty percent of March, as worldwide equities cratered on coronavirus fears. It then climbed back towards $10,000 in the following 2 months as the S&P 500 saw its fastest bearishness recuperation on document.

Nevertheless, being dealt with as a risk possession may be a true blessing in camouflage for bitcoin.

” Considered that the correlation in between BTC and also equities is still so high, our assumption is that this is just favorable for bitcoin price in the short term, as international markets take advantage of an extraordinary quantity of financial stimulus,” claimed Dibb.

Certainly, the United State Federal Get (Fed) and other significant reserve banks are infusing enormous amounts of fiat liquidity into their corresponding economic situations to counter the COVID-19 stagnation. Since last week, Fed’s balance sheet dimension was $7.01 trillion– up 67% from $4.24 trillion in early March, according to information offered by the St. Louis Federal Reserve.

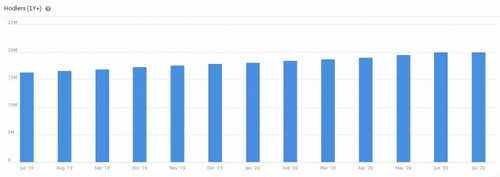

HODLing keeps rising

While bitcoin is having a hard time to develop itself as a sanctuary asset, some investors remain undeterred.

” HODLers” or lasting owners of bitcoin, as determined by the number of addresses storing bitcoin for a minimum of 12 months, rose to a lifetime high of 20.3 million in June. That exceeded the previous high of 19.52 million gotten to in May, as per IntoTheBlock, a blockchain intelligence company.

Addresses holding BTC for a minimum of one year

“With the halving simply lately total, many owners believe that Bitcoin’s median rate must be a whole lot higher than the present worth. This produces more of a hodl type of behavior up until the market starts structure heavy steam once again,” stated Chen.

The metric set a brand-new record high for the 12th straight month in June. Notably, the number of holders is up 22% year-on-year, despite the fact that bitcoin’s price is down 25% over the same period.

At press time, the cryptocurrency is trading at $9,110, having actually dipped to lows near $8,930 throughout the U.S. trading hours on Thursday.