Today saw a 125% increase in the price of dogecoin, a cryptocurrency based on a popular 2013 internet meme, created in the same year as both an apology and also a “allow’s see if this sticks” experiment.

Much to also the creator’s shock, it has not just survived, it has actually built up a loyal following. Plainly.

A team of teenagers on the extremely preferred yet just recently besieged social platform TikTok made a decision to use their voice as well as audience to move the cost of dogecoin up. It has absolutely nothing to do with principles, possible or perhaps federal government handouts– most participants possibly do not also comprehend what cryptocurrency is (most of the video clips describe DOGE as a “supply”). It’s regarding manipulation, even if.

DOGE had a volatile week …

Why is this pertinent? Because it is an irresistibly cosy yet alarming symptom that depend on is essentially barged in markets.

You’re reviewing Crypto Long & Short, a newsletter that looks carefully at the forces driving cryptocurrency markets. Authored by CoinDesk’s head of study, Noelle Acheson, it goes out every Sunday and offers a wrap-up of the week– with insights as well as analysis– from a professional investor’s viewpoint. You can subscribe here.

When you have the next generation of financiers coldly showing off that markets are a worthless gambling enterprise, when you have them promoting that markets can be controlled, then you do have to question what duty markets will have in their lives as they get older.

Nice to have celebrity endorsers …

And just like the day investors choosing stocks from a bag of scrabble tiles, this does raise concerns about the function of truths in our interpretation of worth.

When markets don’t make any kind of feeling, when fundamentals no more appear to matter, it becomes clear the policies are being reworded or perhaps tossed out the home window. We could be in the imaginative damage stage that will pave the way to a brand-new wave of innovation. And in that wave, new kinds of assets might have a reputable place in brand-new sorts of profiles.

However, the untethered nature of present rate reasoning is perplexing, as well as a tip that imaginative devastation can be savage to those caught in the transition. Uncertainty is bad for trust, and also a lack of count on is not great for progress.

So, while I can chuckle with joy at the adorable takes that I can’t stand up to showing you here …

Or is it a “pack chain”?

… I’m also wondering what will certainly have altered most in markets 2-3 years from now. Perhaps sanity will certainly have been restored. Or maybe this is rational in contrast to what’s coming.

A Coinbase listing would certainly not necessarily be good for the marketplace

We can’t not chat regarding the unconfirmed rumors that Coinbase is planning a stock market listing. These reports are not new, but they have actually unexpectedly taken on a restored significance.

Ought to this occur, it would certainly be a big offer for the cryptocurrency industry, however not always the increase many appear to assume.

It would be a big deal for three primary factors:

1) It would concentrate a great deal of conventional focus on the sector in its entirety, as financial reporters spray the word “crytpo,” as equity experts rush to generate records and as financiers are taken aback by the sheer numbers at play in these reasonably ignored markets.

2) We the public would lastly get outlined insight right into the internal workings and accounts of among the sector’s most popular companies (as an analyst, I’m actually eagerly anticipating that).

3) It would supply a noted and liquid possibility for capitalists to obtain direct exposure to the cryptocurrencies. This can put crypto, albeit indirectly, accessible of any capitalist, retail or institutional, as well as perhaps give it a house in pension funds, ETFs, 401Ks, etc.

Just how would this increase the cryptocurrency markets?

Boosted traditional attention can urge more individuals to find out concerning cryptocurrency fundamentals, as well as potentially activate a wave of brand-new investment.

Brand-new funding from an IPO might imply additional growth for Coinbase through a wider reach or a much more substantial service.

Now here is where the “buts” been available in.

Instead of an IPO, the action could simply stand for a handsome departure for the preliminary investors through a direct listing. Even if so, nevertheless, it would certainly establish up a pipe for more financing, which could influence development even more in the future.

As well as, this is also a lot more essential, a public listing of a significant firm such as Coinbase would not always motivate conventional crypto direct exposure. Financial investment would be entering into a firm, not the cryptocurrency market. Real, the financial investment because exclusive company might encourage even more financial investment in the cryptocurrency market additionally down the line, yet the effect would not be straight.

It can even be a self-defeating proposition. Capitalists en masse can choose to purchase shares in Coinbase rather of getting cryptocurrency straight, which ironically could finish up harming Coinbase’s leads.

Ok, that’s an extreme extension of the theory, yet it’s not absolutely impossible.

The internet effect of a Coinbase listing, or any various other considerable cryptocurrency service heading to the frothy securities market, could be web positive for crypto assets. It may not be the financial investment trigger many are really hoping for.

Hashrate highs

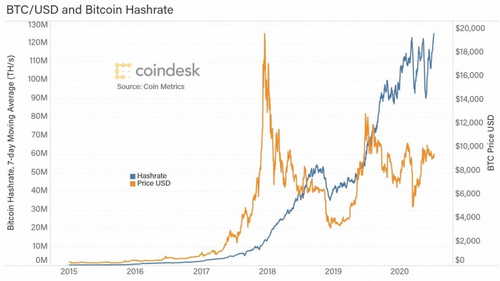

Bitcoin’s hashrate has actually hit an all-time seven-day moving average high, much less than two months after a miner benefit halving caused a 40% decline as unlucrative mining tools was turned off. The hashrate metric is significant because it is a proxy for network security– the higher the hashrate, the more computational power is invested in validating transactions and also keeping the network.

Hashrate tops do not cause price increases

The hashrate reaching all-time 7-day typical highs is being taken as a favorable signal by some. But the numbers don’t birth that theory out.

Hashrate peaks are commonly adhered to by price slumps

As we can see, typically after a hashrate optimal, both cost as well as hashrate autumn over a 7-day and 30-day duration. Hashrate is worth keeping an eye on, since an expanding hashrate suggests growing confidence in the cryptocurrency’s overview.

Any person recognize what’s going on?

You’re probably all aware of exactly how formerly underused as well as reconfigured words and expressions have actually been provided a new life with the present dilemma. “Lockdown,” “social distancing,” not to mention “unprecedented” … And some new words are arising.

The market has been rotating between fits of euphoria and depression. With the highs more than the lows, the net impact is up.

The major brand-new aspect that influenced the market over the last week was the sharp rise as well as loss in the Chinese market. While not a large market by U.S. requirements, this rally underlines a significant distinction in market influences.

Bitcoin barely holding on to its year-to-date lead

The bitcoin market, meanwhile, has been … well … uninteresting in terms of rate and also volumes. The developments in the sector are galloping forward as you will certainly see below in CHAIN LINKS, so the lack of significant market fads does not suggest that we obtain to put down our pencils for a little bit and also take a rest.

CHAIN LINKS

Los Angeles-based fund supervisor Arca has actually launched its Arca U.S. Treasury Fund, an SEC-registered mutual fund that buys U.S. T-bills as well as notes, and also whose digital shares– ArCoins– proceed the ethereum blockchain. TAKEAWAY: This is the very first time the SEC has actually permitted a fund represented by blockchain-based tokens to trade under the 40 Act. Technically the fund’s shares will be crypto property investments, although their value will certainly be based on one of the most secure safety and securities offered: short-term U.S. government financial obligation. This is fascinating due to the fact that it might transform the understanding that regulatory authorities as well as markets have of crypto properties as a whole, as well as it might begin to wake general funding markets as much as alternative trading devices. Whether this fund removes or otherwise, it is a pioneering action towards what can be the capital markets of tomorrow.

Kraken Futures, formerly called Crypto Facilities, has actually been granted a Multilateral Trading Facility (MTF) permit from the U.K.’s Financial Conduct Authority. TAKEAWAY: This makes Crypto Facilities the initial qualified crypto by-products platform for the European market, and also we might quickly see the launch of EUR-denominated crypto products.

The London Stock Exchange Grouphas included 169 electronic properties to its SEDOL Masterfile solution, a worldwide database that appoints distinct identifiers to monetary tools. This helps LSEG clients maintain track of traded properties from implementation to settlement. TAKEAWAY: This is not an official seal of “authorization,” yet it’s worth asking why they would do this if it’s not to consist of electronic assets in their offering eventually in the future.

The CFTC, which controls the U.S. bitcoin as well as ether by-products markets, plans to establish an electronic property advancement plan by 2024. TAKEAWAY: That may seem like a very long time in the future, however in regards to brand-new regulatory structures, it’s really not, and also it does highly suggest that the CFTC is already servicing it. So, we can expect extra examination, interaction and also events from the globe’s principal by-products regulator over the coming months, which need to hint at the position global derivatives regulatory authorities around the globe could take.

The CENTRE Consortium, which provides the dollar-pegged USDC in addition to the ethereum blockchain, blacklisted a USDC address in action to a police demand, freezing $100,000 worth of the stablecoin. TAKEAWAY: That this is even possible– the cold of a cryptocurrency account– highlights the centralized nature of many fiat-backed stablecoins flowing today, and ought to comfort regulatory authorities that they are not always going to bring about higher money laundering as well as economic criminal offense. CENTRE’s participation with legislation enforcement, while taboo to initial crypto libertarians, could also place it as a complement to the eventual electronic buck, ought to that happen. There will certainly constantly be need for monetary transfer systems without seizure threat; but institutional participants require to stay with the controlled space, in which the seizure option is likely to be a need.

My colleague David Pan outlines the possible influence on crypto market facilities of Hong Kong’s national safety regulation. TAKEAWAY: For instance, the Hong Kong Autonomy Act passed by the U.S. Senate this week punitive stipulates that the U.S. federal government ought to limit international financial institutions and also subsidiaries of U.S. financial institutions in Hong Kong from accessing the U.S. dollar system if they conduct considerable deals with China. That can raise market friction as it comes to be harder for Hong Kong-based firms to access U.S. bucks. Hong Kong is a significant crypto market hub, so it remains to be seen if this will affect trading quantities. It’s likewise worth watching on stablecoin circulations, as they might be a temporary workaround.

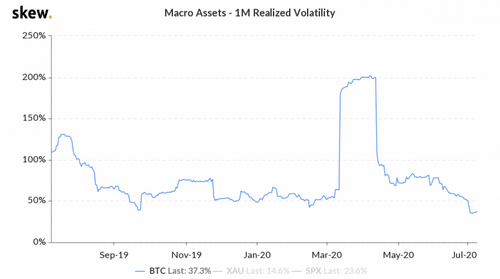

The last time it was this reduced, it preceded a sharp cost drop. This time, capitalists direct to raised telephone call acquiring as an indication the breakout might be on the upside.

BTC understood volatility proceeds its trend down

Continuing on the motif that not much is taking place in the crypto markets, CryptoCompare’s month-to-month Exchange Report highlights the loved one absence of area and acquired volumes.

The fiat USD share of the BTC market is shrinking

Switzerland-based crypto lending institution Nexo is preparing to become a prime broker with help from oracle provider Chainlink, which will power audits to bring more openness to Nexo’s operations. TAKEAWAY: Audited loaning as well as borrowing would be good information for the industry, improving rely on the collateral as well as the yields. I am, nonetheless, starting to notice the appearance of a buzzword (“prime broker”) that is starting to shed its initial definition.

Nic Carter and Matt Walsh of Castle Island Ventureswrote an engaging overview of the evolution of electronic bucks, worth a read for any individual attempting to stay on par with what’s taking place in stablecoins (fiat-backed along with synthetic) as well as reserve bank electronic currencies.

Investment would certainly be going right into a firm, not the cryptocurrency market. Real, the financial investment in that private company might encourage even more financial investment in the cryptocurrency market additionally down the line, but the impact would not be straight.

The major brand-new factor that influenced the market over the last week was the sharp surge as well as loss in the Chinese market. While not a big market by U.S. criteria, this rally highlights a substantial distinction in market affects. Hong Kong is a significant crypto market hub, so it continues to be to be seen if this will influence trading quantities.