Chainlink’s link token jumped to tape high up on Monday, far exceeding bitcoin’s returns since the beginning of 2020. The ever-increasing use of Chainlink’s price oracles in decentralized money (DeFi) is driving the cryptocurrency higher, according to analysts.

The 12th largest cryptocurrency by market value clocked a lifetime high of $5.72 at 11:45 UTC (7:45 a.m. ET) as well as was last trading at $5.65, standing for over 200% gains on a year-to-date basis.

Bitcoin is down more than 50% from its lifetime high of $20,000 gotten to in December 2017 as well as has actually gained only 29% so far this year, according to data source Coin Metrics.

The link cryptocurrency has decoupled from bitcoin, the crypto market leader. Onlookers are associating web link’s substantial rally with Chainlink’s boosted usage in the decentralized financing room.

” We’re associating this short-term cost spike to Chainlink’s scaled usage in the DeFi area,” said Vance Spencer, co-founder of Framework Ventures, which is just one of the biggest private owners of link symbols. “The market cap for DeFi projects have actually quintupled in the last half year, and many of the environment is currently depending on (or intending to rely on) Chainlink for connecting on-chain DeFi smart contracts to off-chain information feeds like commodities as well as crypto rate information.”

Simon Peters, crypto market expert at financial investment platform eToro said, “The crypto asset has been presenting a bullish fad for some time now, with Chainlink making all the appropriate sounds by partnering with a number of projects in the decentralized finance (DeFi) room.”

Chainlink is a system of oracles improved top of the Ethereum blockchain that provides information to decentralized blockchains. For instance, if 2 users wager on the outcome of a binary occasion, the oracle will certainly inform the wise agreement which user won, so it can pay the winning wagerer.

With Chainlink, the benefit is that it provides data to clever contracts in a decentralized way, or from numerous sources. That ensures the protection and also dependability of the blockchain, which can be endangered in instance the oracle depends upon a solitary resource. For example, offering protocol bZx experienced numerous hacks in February as the platform once made use of Kyber Network as a solitary oracle, or distributor of property rates.

The DeFi market has actually transformed to Chainlinks. Significant names in the DeFi area including Kyber Network, AVA, Graph Protocol, Opium Network, Synthetix and now bZx have incorporated Chainlink’s oracles, according to its official blog. Chainlink’s main twitter take care of has introduced at the very least two collaborations each week over the last two months.

The cryptocurrency might have received an additional increase from Chainlink’s association with China’s nationwide blockchain job. “The value of the Chinese federal government picking to integrate Chainlink oracles right into their nationwide blockchain solutions network (BSN) can not be downplayed,” claimed Spencer.

Looking forward

” Long term, we anticipate Chainlink’s worth to continue to value. Our team believe that the smart agreement platform that ultimately comes to be the requirement for Web3 will be valued at several aspects more than Ethereum’s current market cap. If that holds true, then it’s natural to presume that its security layer, Chainlink, will considerably grow in worth also,” claimed Spencer.

Some observers feel Chainlink is best positioned to profit from the continuous multi-year shift in emphasis from base layer chains to the middleware services that offer protection for data feeds.

Further, the appeal of earning extra by laying link symbols can drive need for the cryptocurrency. “The idea that users might someday earn a constant revenue stream for joining the crowdsourcing of useful data for smart contracts is most likely to be appealing to institutional as well as educated retail capitalists alike,” claimed Spencer.

In Chainlink’s ecosystem, betting entails depositing link tokens in a node in order to have the ability to undertake work that call for security or signing up with a laying poll in order to connect blockchain to off-chain information, as kept in mind by crypto exchange Exodus.

Temporary improvement ahead?

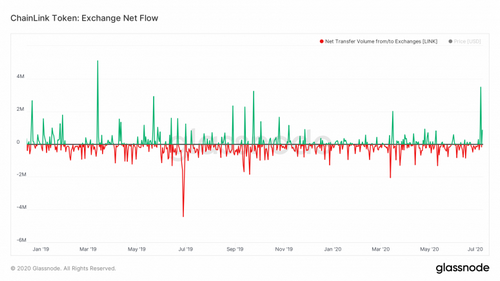

With the flow of coins toward exchanges lately leaping to the highest degree given that March, there’s a chance the cryptocurrency might witness a short-term pullback.

Chainlink Token: Exchange Net Flow

Exchange net circulation, or the difference between quantity streaming into and also out of exchanges, increased to 3,482, the greatest considering that March 14, according to information offered by the blockchain analytics solid Glassnode.

When they anticipate a rate pullback, financiers often tend to relocate cryptocurrency from their budgets to exchanges to be able to a lot more swiftly sell off holdings throughout a rate crash or.

“From a technological viewpoint, link simply damaged past its largest resistance level at ~$4.90 and also is currently in price exploration mode both in regards to BTC and also USD,” said Connor Abendeschien, crypto research study analyst at Digital Assets Data.

With Chainlink, the benefit is that it provides data to wise agreements in a decentralized method, or from several resources. Major names in the DeFi space consisting of Kyber Network, AVA, Graph Protocol, Opium Network, Synthetix and currently bZx have incorporated Chainlink’s oracles, according to its main blog. Chainlink’s main twitter deal with has actually announced at the very least 2 collaborations every week over the last two months.

” Long term, we anticipate Chainlink’s worth to continue to value. If that is the instance, after that it’s natural to think that its protection layer, Chainlink, will considerably expand in value as well,” said Spencer.