Entrepreneurs in the white-hot sector of decentralized money have used cryptocurrency modern technologies to develop automated systems that may one day test and even replace traditional banks as well as exchanges.

Now, DeFi is handling the asset-management sector, as well as currently launching a series of new financial investment items made to maximize its own success.

You’re reading First Moving company, CoinDesk’s daily markets e-newsletter. Assembled by the CoinDesk Markets Group, First Moving company starts your day with one of the most updated sentiment around crypto markets, which obviously never close, placing in context every wild swing in bitcoin and also more. We adhere to the money so you don’t have to. You can subscribe below.

One such project is PieDAO, a so-called decentralized autonomous company conceived and established by a team of DeFi developers headed by Berlin-based DexLab. Earlier this year PieDAO raised about $5 million with a sale of digital symbols, called DOUGHs. The network went live in March– equally as bitcoin and also most typical economic markets like supplies were crashing as a result of the dispersing worldwide pandemic.

The PieDAO system, a decentralized application constructed atop the Ethereum blockchain, creates its very own version of digital tokens called “pies.” They function like tokenized mutual fund whose worth is connected to a basket of other digital tokens, which consequently are sourced from a decentralized liquidity swimming pool called Balancer.

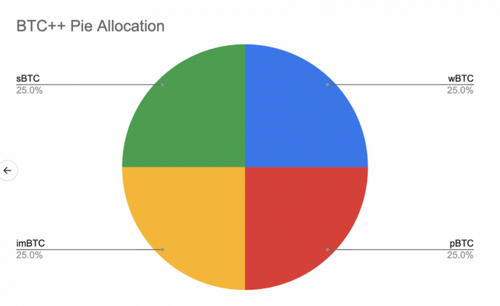

In April the job presented its first pie, called BTC++, which is backed by tokenized versions of bitcoin. As well as stakeholders in the job have because pushed out a 2nd pie called USD++, backed by united state dollar-linked stablecoins.

Yet PieDAO’s initial actual push toward complete decentralization began last month, when financiers were allowed to begin acquiring DOUGHs straight from the job in exchange for ether, the native token of the Ethereum blockchain, with a minimum down payment worth about $500. For now, DOUGHs aren’t openly traded.

Such tokenized automobiles have actually been described by experts as the digital-asset version of exchange-traded funds, or ETFs, a sort of financial investment automobile in traditional financial markets that can be traded like stocks.

” It’s extremely interesting to see more experiments to re-invent monetary applications we have never ever seen before,” Soravis Srinawakoon, co-founder and also chief executive officer of Band Protocol, a cross-chain information oracle for the DeFi space, wrote in a Telegram message.

Pie chart revealing assets in basket backing PieDAO’s BTC++ tokens.

PieDAO isn’t the initial ETF-like company for the electronic property area. The Establish Procedure, likewise on Ethereum, permits individuals to invest and even create their own baskets of possessions called “Collections,” which like Pie are completely tokenized. One more alternative, according to a report Monday from the cryptocurrency evaluation firm Delphi Digital, is the sDEFI token from Synthetix.

Yet PieDAO takes the tokenization idea an action even more, given that the DOUGHs provide holders the capacity to influence the financial investment automobile’s administration– on matters ranging from the weight of the underlying financial investment indices and also approaches for asset-rebalancing, to the level of fees billed and also when to pay a cut of those fees.

The issuance as well as transfer of the DOUGHs functions to equalize the governance of the financial investment vehicle, roughly similar to the method investors can have stock in a money-management business.

Thus far, just 131 addresses hold DOUGHs, covering the initial token owners– including founders, core designers and also very early investors– as well as brand-new buyers, according to block traveler Etherscan.

DexLabs CEO Alessio Delmonti, that according to his LinkedIn profile formerly functioned as a mobile-app developer, informed CoinDesk in a straight message using Twitter that the plan is to offer DOUGH symbols currently kept in a reserve fund to new purchasers. The objective is for 75% of the overall supply to be distributed by early 2021, up from just over 50% currently, he stated.

” Eventually it depends on the DAO to vote the proposal in for final circulation,” Delmonti stated. The job’s white paper still hasn’t been published due to the fact that it’s still in “active writing and presently present of the area,” he claimed.

PieDAO’s area members are currently holding discussions on prepare for new pie tokens, according to Delmonti. There’s a Google spreadsheet that summarizes a few of the propositions, consisting of new pies backed by baskets of DeFi-related possessions, such as symbols from the ChainLink, MakerDao and also Compound projects.

” PieDAO is a fascinating service which essentially incorporates DAOs and DeFi, to develop a new means to manage and create crypto index funds,” expert Alex Gedevani wrote in Monday’s Delphi Digital report.

While still tiny, DeFi is just one of the fastest expanding edges of the digital-asset industry. Overall worth secured (TVL) in DeFi applications– a proxy for just how much money is really taken into the systems– has actually approximately tripled this year to the matching of concerning $2.1 billion, according to analytics website DeFi Pulse

Chart of total U.S. buck worth locked in decentralized finance protocols.

This market pep has added to a doubling this year in ether’s rate. The frenzy surrounding another DeFi project, the lending institution Compound, whose market capitalization soared to $1 billion within a week of its public launch last month, from less than $10 million initially, according to CoinGecko

Doubters of the jobs have likewise pointed to the threats of placing money into these little-tested tokens, which can be vulnerable to malicious ventures along with rampant conjecture and also mispricing.

The PieDAO tokens already trading have actually gained from this year’s gains in cryptocurrency markets; that holds true for BTC++, for instance, since its price generally tracks bitcoin.

Rate chart of PieDAO’s BTC++ tokens.

In the meantime, the project is still little even by the standards of the inceptive cryptocurrency sector; the marketplace value of BTC++ has to do with $1.4 million currently, and also it’s $2.7 million for USD++. For contrast, bitcoin, the earliest and also biggest cryptocurrency, has a market value of concerning $173 billion, as well as No. 2 ether’s is $27 billion.

The cryptocurrency market is duplicating services long dominated by Wall Street and also banks, from margin finances and derivatives trading in digital-asset markets, to blockchain-based settlement and also lending systems. Asset management is an additional frontier; the reasoning is that many ETF-style investment cars will eventually be tokenized for trading in much faster, less expensive and even more personalized digital-asset markets.

And also the cryptocurrency market isn’t waiting around, with the U.S. Securities and also Exchange Payment having actually thus far rejected to accept a bitcoin ETF.

” Instead of ‘trusting’ a single authority like an asset manager, you are trusting the wisdom of the crowd with these decentralized self-governing organizations,” Srinawakoon stated. “Is it shown? No. Is it fascinating as well as can potentially be turbulent? Yes.”

Bitcoin watch

BTC: Rate: $9,368 (BPI)|24-Hr High: $9,475|24-Hr Reduced: $9,286.

Trend: The path of least resistance for bitcoin seems on the higher side.

The cryptocurrency is trading near $9,400 at press time, having actually leapt 2% on Wednesday to validate an upside break of a dropping network, represented by trendlines linking June 1 and also June 22 highs and June 2 and June 15 lows.

The bearish network outbreak indicates the downward action from the June 1 high of $10,429 has actually ended and the bulls have actually reclaimed control. The cryptocurrency has additionally turned the widely-tracked 50-day relocating standard (MA) resistance right into support. The MA is presently located at $9,373.

The outbreak is backed by an above-50 or bullish analysis on the 14-day relative stamina index. Additionally, the MACD is currently creating higher bars above the no line, an indication the upward move will collect vapor.

As such, one may expect bitcoin to test the resistance at $9,800 (June 22 high) over the next couple of days. Acceptance over that degree would certainly reveal the June 1 high of $10,429.

The favorable case would be invalidated if the spot price goes down below the 10-day SMA, currently at $9,373.