That question obtains harder to answer every day as new digital properties join the thousands currently traded. Those looking to figure out which ones are the most crucial have frequently pre-owned easy metrics such as market capitalization to sort with the Lego pile of symbols and also coins.

Which cryptocurrencies matter most to the marketplace?

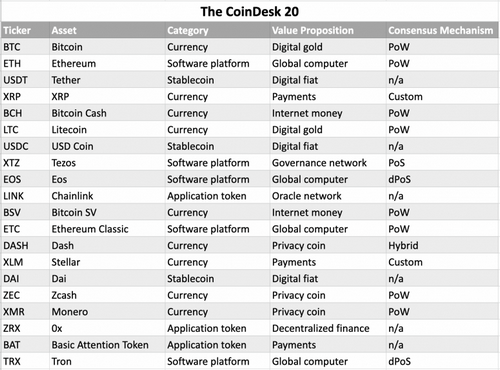

That’s why CoinDesk has actually launched the CoinDesk 20. This team of 20 digital properties makes up the majority of what individuals suggest when they claim “the cryptocurrency market.” However quantity is not the single requirement for inclusion.

Returns of the CoinDesk 20 for 2020 Q2.

While these 20 stablecoins, symbols as well as cryptocurrencies with each other deserve more than 90% of the entirety of the crypto market, the listing is not derived just from evaluations. Instead, it includes a smarter method to find the properties most pertinent to the marketplace.

An extra sophisticated technique.

It begins with the exchanges. Not every exchange– far from it.

On the wild frontier of crypto trading, numerous exchanges appear constantly. Few are credible and also dependable. Just a sliver have actually done what they can to eliminate control.

CoinDesk’s study group analyzed numerous studies on the honesty of trading volumes on cryptocurrency exchanges. The group resolved on reports from 3 different clothing– Bitwise, The Block as well as Digital Asset Research– as the ones deemed to have the soundest research study. Of the loads of venues the records assessed, only eight exchanges appeared on all 3. Those eight are Bitfinex, Bitflyer, Bitstamp, Coinbase, Gemini, itBit, Kraken and also Poloniex.

To be certain, each of those exchanges supplies traders price exploration on some key markets. Their exclusion from the CoinDesk 20 may be taken another look at in the future.

From the team of eight exchanges, CoinDesk added up the quantity on every asset traded by quarter, utilizing data supplied by Nomics. Any type of cryptocurrency or electronic property that doesn’t trade on at least two of the eight exchanges didn’t receive the CoinDesk 20 because having a possession trade on greater than one exchange makes it possible for arbitrage opportunities must rates relocate too way out of whack from one venue to another. That makes sure the rate as well as quantity data reflect the real market. We after that ranked the cryptocurrencies by volume over the last two consecutive quarters. Carrying out the position over two quarters removes any property that would have, say, one active month however otherwise reveal no sustained trading volume. Utilizing the same model, CoinDesk will re-run this evaluation every quarter and also upgrade the listing as necessary.

It needs to be noted Bitwise no much longer includes Bitfinex’s rates in how it determines its index worths, a separate operation from its “actual quantity” calculations. It’s the last that matters in the technique for picking the CoinDesk 20.

Bitwise remains to include Bitfinex in the exchanges adding to that action of volume, the information for which continues to be upgraded and also published. Bitwise removed Bitfinex from its index prices sources in 2019 after the New York Attorney General filed a claim versus the exchange. It did so as a result of worries concerning rates drifting in the future should anything happen in the legal case. In an e-mail Wednesday, Bitwise’s head of research informed CoinDesk, “We still extremely much think that Bitfinex has real volume.”.

The Bitwise actual quantity record of March 2019 also notes that Bitfinex used market security devices to “help spot market controls, such as spoofing and also laundry trading with the historical and also real-time analysis of professions, order publications as well as other market info.” This set it in addition to some various other exchanges Bitwise checked, including Binance. Did the fact that Bitfinex registered as a cash solutions service with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN).

What’s even more, as of June 17, the current CoinDesk 20 represented $239.38 billion in market cap, according to information put together by Messari. That makes the CoinDesk 20 rep of 90.3% of the entire cryptosphere’s market cap.

By the same token, the CoinDesk 20 is not a ranking of the relative worth or relevance of each crypto or blockchain job. It is not a judgment on the top quality of the modern technology or the quality of the group creating it. No question some viewers will certainly have strong point of views on why this or that property must be in the CoinDesk 20 as well as why others shouldn’t be. No question, over time some newbies will certainly join this list and also existing properties will certainly leave it. In the meantime, however, these are the results of a clear, objective technique utilizing reliable data.

Such is the case when checking out tether (USDT) on the CoinDesk 20 property web page. As we go real-time, the market cap shown for the stablecoin is roughly $6 billion. Those are valued at an extra $4.9 billion, and also CoinDesk is functioning on a means to incorporate prompt and also precise figures for these other blockchains into the complete number.

A lot more information.

CoinDesk is doing even more than simply making a checklist of assets, however. Additionally, traders, investors and scientists are offered with a deep dive into the information they require to make educated decisions regarding these 20 electronic assets.

Each specific asset page consists of information regarding the kind of currency, its returns, volume, volatility, deals, costs, worth proposition and agreement system, to call just a few of the information points. This will certainly give anybody researching the possession a clearer feeling of exactly how it relates to others as well as to various other property courses.

The possessions in the CoinDesk 20.

The CoinDesk 20 is a new tool for examining a new area. We eagerly anticipate evolving it– meticulously and also slowly– as the field of electronic possessions proceeds. We’ll definitely fine-tune the data we ingest as well as change just how we offer it on our asset web pages. We might even take another look at the approach based on brand-new viewpoints as well as visitor feedback. We welcome you to share yours. If you have thoughts on the CoinDesk 20, please share them at research@coindesk.com.

In a possession course that is typically stuffed with uncertainty, the CoinDesk 20 is meant to offer as a vital tool for the crypto investor. It’s a simple list of 20 assets, but behind that list is a sophisticated lens, one that reveals the true centers of gravity within the cryptocurrency market.

That’s why CoinDesk has actually introduced the CoinDesk 20. From the team of 8 exchanges, CoinDesk included up the quantity on every asset traded by quarter, making use of information given by Nomics. Any kind of cryptocurrency or electronic possession that does not trade on at the very least 2 of the 8 exchanges didn’t certify for the CoinDesk 20 since having a property trade on even more than one exchange makes it possible for arbitrage chances should prices relocate also much out of whack from one venue to one more. No doubt some viewers will have solid viewpoints on why this or that asset ought to be in the CoinDesk 20 and why others should not be. Such is the case when viewing secure (USDT) on the CoinDesk 20 possession page.