Capitalist rate of interest in ether alternatives is stronger than ever, potentially as a result of excitement surrounding Ethereum’s long-awaited procedure adjustment, called ETH 2.0.

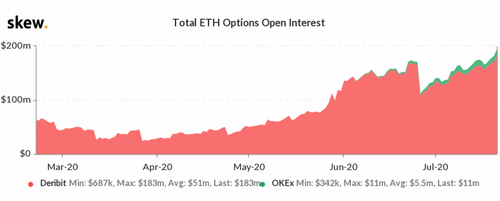

Data from major exchanges– Deribit and OKEx– reveals that open rate of interest in ether alternatives rose to a brand-new life time high of $194 million on Tuesday, surpassing the previous record high of $173.4 million reached on June 23, according to data provided by the crypto derivatives study firm Alter

Alternatives are acquired agreements, which give the buyer the right yet not the commitment to buy or market the hidden asset at a predetermined rate on or prior to a certain date.

A phone call alternative represents a right to get, while a put option offers a right to sell.

Ether alternatives open interest

The Panama-based Deribit exchange, the globe’s biggest choices exchange by volume, accounted for nearly 94% of the total open rate of interest of $194 million on Tuesday.

Planning for ETH 2.0?

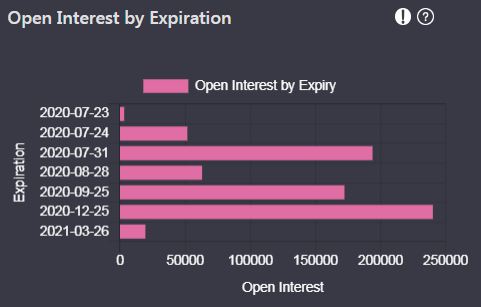

A closer consider the circulation of the open rate of interest based on expiry reveals December as the month with the most open rate of interest.

Ether open interest by expiration

At press time, there are 240,237 open agreements with a notional worth of $59 million ending in December. Meanwhile, the July expiry open passion is 193,919 agreements ($ 47 million notional), according to Genesis Volatility, an options information platform.

” Focus of task in December expiry suggests investors may be gearing up for ETH 2.0,” stated Greg Magadini, CEO of Genesis Volatility, an acquired data system.

Luuk Strijjers, COO of Deribit, told CoinDesk in a Telegram conversation that, “the bullish energy in open passion is based upon the upcoming ETH 2.0 laying possibility.”

ETH 2.0 refers to Ethereum’s long-awaited change from a proof-of-work (PoW) system to proof-of-stake (PoS). The button to staking device would certainly aid ether owners create additional yield by laying their symbols in the network. The shift, which was initially anticipated in the first quarter, currently might not take place till early following year.

However, investor passion in the cryptocurrency is rising. The number of addresses holding 32 ETH or even more– the minimal quantity an owner is required to keep as an equilibrium to end up being a validator on Eth 2.0 (and thus gain laying rewards)– has actually increased by over 12% on a year-to-date basis to 123,530, according to information resource Glassnode. Furthermore, ether has gotten 90% this year contrasted to bitcoin’s 30% rise.

Some financiers may be expressing their bullish view on the cryptocurrency by acquiring call alternatives running out in December, creating a rise in the open interest. Also, the opportunity of financiers hedging their long place placements with long put choices can not be eliminated. Nevertheless, the shift has actually already encountered numerous hold-ups and also the cryptocurrency’s rate may drop if the upgrade is once again pushed out past January 2021.

The DeFi harvest

And also yet, ETH 2.0 might not be the only factor for the surge in open rate of interest in ether options. “The recent DeFi success and the growing negotiated value in stablecoins may have played a role,” Strijjers said.

Undoubtedly, using ether options as a bush may be boosting demand. That’s because there are concerns that the frenzy bordering speculative tasks such as “return farming” in the DeFi space as well as interconnected leverage would result in a systemic situation. Many DeFi projects are based on Ethereum and also have witnessed extraordinary development over the past few months, triggering a large surge in the network activity and changes charges.

One might argue that financiers, searching for yield, might be marketing call and placed choices. That appears not likely, especially in longer outdated options, offered the cryptocurrency’s one-month indicated volatility is hovering well listed below its lifetime standard of 71%. The metric fell to a multi-year low of 46% on July 3 and has actually continued to be mostly sidelined ever since according to data source Skew.

Volatility has a favorable influence on alternatives’s cost and is mean going back. To put it simply, there is a likelihood of seeing volatility rising in the near term as well as making choices more expensive than what they are right now.

As such, experienced investors prefer to be alternative purchasers when volatility is low and also write options when they think volatility has actually come to a head.

That said, the opportunity of traders having actually offered July expiry alternatives can not be eliminated, provided the cryptocurrency has invested a bulk of the last 2 months trading the slim range of $225 to $250.