Bitcoin has at last busted well above the critical $10,000 mark, yet why has it struggled so much in current months when gold has soared to an all-time high?

Earlier this year, digital-asset financiers were aflutter over the trillions of bucks of central bank cash injections in feedback to the coronavirus-induced international economic crisis. The wager was the flooding of liquidity would at some point bring about inflation, consequently increasing rates for both gold, traditionally viewed as a bush versus currency reduction, as well as bitcoin, often described as “digital gold” or “Gold 2.0” as a result of its scarce supply.

Yet, since the end of April, when the coronavirus-related market gyrations decreased, bitcoin has actually dragged gold, frustrating the cryptocurrency’s investment narrative.

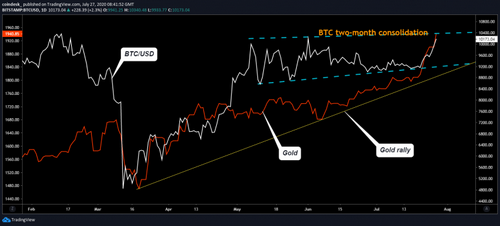

Gold and also bitcoin chart.

Gold costs have actually risen throughout the period, last week covering the all-time closing high of $1,891.90 an ounce gotten to in 2011, and also are now trading at a record intraday high of $1,940 per ounce. The previous lifetime high of $1,921 was reached in September 2011.

Bitcoin, on the other hand, has actually been embeded a slim trading variety since April and also only just last evening clambered to $10,200, a level stone’s throw off half of its all-time-high of $20,000 reached in 2017.

According to a handful of investors and also analysts interviewed by CoinDesk, bitcoin is far much less mature than gold as well as hence may lack a qualified history as a rising cost of living bush. It’s struggled to attract hedging bids in spite of a recent uptick in rising cost of living assumptions.

” Bitcoin’s rising cost of living sensitivity hasn’t been evaluated in the last 10 years as there hasn’t been a sustained surge in rate stress.” Charlie Morris, owner of the investment company ByteTree Asset Management, said in an audio meeting using WhatsApp.

It’s a change in tone from a few months back, when the favorable hype over bitcoin was so common it crowded out any type of reservations regarding bitcoin’s restricted trading background or market dimension. Instantly, there’s no shortage of caveats to explain why bitcoin hasn’t reflected the inflation assumptions that seem to be buoying gold.

To add fuel to the fire, various other edges of cryptocurrency markets are white-hot: ether, the second-largest cryptocurrency after bitcoin, has acquired some 150% this year. Bitcoin is up 42% in 2020.

” Bitcoin has its own microeconomics really distinct to crypto, including mining difficulty cycles, the transforming regulatory environment and other elements that have little to do with rising cost of living,” Richard Rosenblum, co-founder of GSR, informed First Mover in a Telegram conversation.

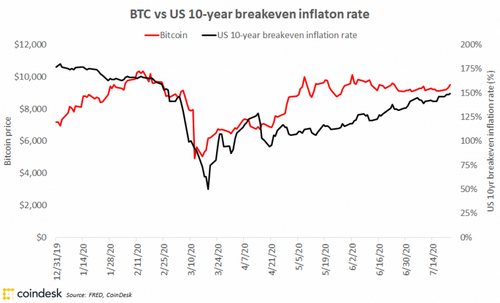

U.S. rising cost of living expectations, as implied out there for the U.S. 10-year breakeven rising cost of living rate, have actually risen to 1.51%, the highest since February. They’ve climbed from 0.5% on March 19, as the Federal Reserve’s balance sheet increased by greater than $3 trillion.

Bitcoin initially increased together with the uptick in inflation assumptions. The relocation from $3,867 to $10,000 seen in the two months to mid-May was likely fueled by the favorable story bordering the May 12 halving. Ever since, the cryptocurrency was locked in the series of $9,000 to $10,000 up till July 26, while inflation expectations remained to rise.

Gold, nonetheless, has actually drawn a regular quote over the past four months, provided its lengthy history of serving as an inflation bush, according to Joseph Trevisani, an analyst at FXStreet as well as former exclusive trader at Credit Suisse.

The yellow metal rose by a typical 15% in genuine or rising cost of living adjusted terms in the 8 years between 1974 to 2008 when yearly U.S. rising cost of living, as measured by the consumer price index, was above 5%, according to the Journal of Wealth Management. Gold more than increased to about $1,920 from $850 in the three years complying with the mid-2008 crash, as the Fed’s emergency situation liquidity injections pressed rising cost of living assumptions higher.

” Gold’s history as a rising cost of living bush is popular,” Trevisani told First Mover in a Slack conversation. “Gold is an enduring hedge versus catastrophe. Bitcoin is not, or at the very least it is unverified.”

Certainly, bitcoin’s whole existence, since it was released in early 2009, has actually happened in a low inflation setting. The 10-year breakeven rising cost of living price dropped from 1.6% to -0.62% in the two years through 2013, and also it stayed embeded an array between 0% and also 0.8% from 2014 to January 2020. That’s well below the Fed’s 2% target for annual rising cost of living.

The gold market, at around $10 trillion, has adequate deepness as well as liquidity to soak up big hedging-related or haven inflows. Bitcoin’s market capitalization is fairly paltry, at $189 billion.

” Gold is like a tanker, while bitcoin is a lot more like a speedboat,” Gavin Smith, CEO of the cryptocurrency hedge fund Panxora, told First Mover in a telephone interview. “However, looking out 3 to 5 years, you’ll see the trajectory of both, and also you’ll say both were an inflation play.”

An additional variable stopping institutions as well as other traditional capitalists from making large profile allocations to bitcoin is an idea that its price activity as well as network basics aren’t as intimately linked as gold to the fate of the global economic situation.

” Bitcoin is interesting however I think that it informs us little concerning anything in the real world,” Marc Chandler, a previous chief money planner for the giant British financial institution HSBC, told First Mover in a LinkedIn chat.

Reserve banks, which do not buy bitcoin, typically acquire gold in times of anxiety, as well as they were net buyers during the virus-stricken very first quarter, according to the data source Gold Hub.

” Nothing is up fairly as much as gold,” Mati Greenspan, founder of the cryptocurrency as well as foreign-exchange evaluation company Quantum Economics, created Friday in an email to clients. “The lack of a major bitcoin rally is also a little bit perplexing, particularly as one of the leading stories for the existing action in gold is the lack of confidence in central financial institutions.

After bitcoin’s rise on Sunday, only time will inform if that process has just begun.

Bitcoin watch

BTC: Price: $10,241 (BPI)|24-Hr High: $10,334|24-Hr Low: $9,829.

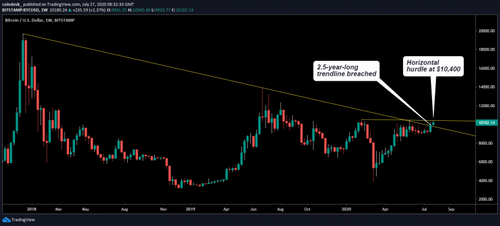

Pattern: Bitcoin may get on the cusp of major bull run, having removed a significant resistance at the weekend break, according to one analyst.

The cryptocurrency leapt over 8% in the 7 days to July 26, breaching a trendline connecting the December 2017 as well as July 2019 highs. “This could be the real offer, we could be on the very first major action towards a bull run of impressive magnitude,” prominent analyst Lark Davis tweeted early Monday.

Some traders are currently betting on a move to $20,000 over the next four months. Undoubtedly, the outbreak above the 2.5-year-long falling trendline is a significant favorable development. BTC is yet to go across over resistance at $10,400– a straight resistance line attracted linking the February as well as June highs.

The cryptocurrency has fallen short several times to keep gains over $10,000 over the last 12 months. As such, the bulls would be better off observing caution as long as rates are held below $10,400.

A break above that degree, if validated, would unlock to $11,000. On the other hand, a failure to develop a solid footing above $10,000 might welcome stronger selling stress.

At press time, bitcoin is changing hands near $10,241, representing a 3% gain on the day.

Bitcoin originally increased together with the uptick in rising cost of living assumptions.” Gold’s background as a rising cost of living hedge is well known,” Trevisani informed First Mover in a Slack conversation. Bitcoin is not, or at least it is unverified.”

Bitcoin’s whole presence, because it was launched in early 2009, has taken area in a low inflation environment. “The lack of a significant bitcoin rally is likewise a little bit puzzling, particularly as one of the leading stories for the existing action in gold is the lack of confidence in central financial institutions.