Bitcoin’s price pressed as high as $11,460 on increased buying quantity Friday, proceeding its favorable go to cap a week of economic unpredictability.

” The U.S. Q2 GDP results were rough as well as standard markets are seeing a bit of danger off– a sharp action lower in returns and weak point in supplies,” Dan Koehler, liquidity manager for cryptocurrency exchange OKCoin, told CoinDesk. “It’s an important time for bitcoin, in my sight.”.

Without a doubt, supplies are taking a beating Friday, with major worldwide indexes down or flat.

Bitcoin as well as ether continue to make gains Friday as well as stakeholders are progressively investing their crypto right into DeFi.

Bitcoin (BTC) trading around $11,333 as of 20:00 UTC (4 p.m. ET). Getting 2% over the previous 24 hrs.

Bitcoin’s 24-hour variety: $10,974-$ 11,460.

BTC over 50-day and 10-day relocating averages, a favorable signal for market specialists.

Bitcoin trading on Coinbase since July 28. Resource: TradingView.

Bitcoin (gold), S&P 500 (blue), FTSE 100 (environment-friendly) and Nikkei 225 (red) in July.

Bitcoin beat major equity indexes for July, up over 20% for the month. “It will certainly be interesting to see how bitcoin acts in a risk-off setting this time about, having broken and also so far held above $10,400,” included OKCoin’s Koehler.

Michael Rabkin, head of institutional sales at crypto trading firm DV Chain, claimed a favorable information cycle on the crypto front is helping the marketplace. “We’ve been seeing even more purchasing over the last few days, especially since the past week’s statement which would certainly permit financial institutions to hold custody,” he claimed.

” There’s absolutely an extra favorable belief since that news appeared and as we’ve seen, has actually resulted in higher energy,” Rabkin added.

Mostafa Al-Mashita of Global Digital Assets, a digital assets-focused seller financial institution, claimed different cryptocurrencies, or altcoins, is where he anticipates investors to take profits near-term. “The market is settling as altcoins reach the current bitcoin pump,” he stated. “I would anticipate altcoins to lead for a few days before bitcoin increasing once again.”.

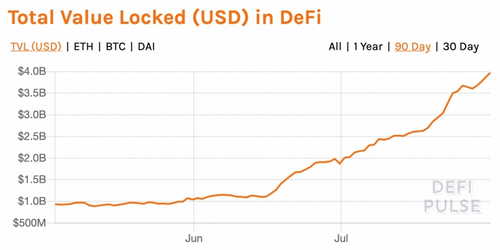

DeFi secured at $4B.

Ether (ETH), the second-largest cryptocurrency by market capitalization, was up Friday, trading around $344 as well as climbing up 3.1% in 24 hrs as of 20:00 UTC (4:00 p.m. ET).

Because June 1, the complete worth secured Ethereum-powered decentralized money, or DeFi, has actually climbed 300% from $1 billion to $4 billion, according to information aggregator DeFi Pulse.

Total secured DeFi the past three months.

In simply two months, complete bitcoin locked in DeFi greater than quadrupled from 4,975 to 20,610 BTC. Complete ether secured DeFi has actually grown 60%, from 2.6 million to 4.2 million ETH. Stablecoin dai secured is up 19%, from 365 million to 435 million.

Azamat Malaev, co-founder of HodlTree, a new DeFi method for interest-yielding symbols, claimed the catalyst for this development was financiers securing crypto with a specific big DeFi lending institution to accomplish “yield” or earnings. “It began with the launch of the Compound token distribution on June 15,” he stated. “And, naturally, with a time delay information started to spread out.”.

“The market is settling as altcoins catch up to the recent bitcoin pump,” he claimed. “I would expect altcoins to lead for a couple of days prior to bitcoin increasing once again.”.

In just two months, total bitcoin secured in DeFi more than quadrupled from 4,975 to 20,610 BTC. Complete ether locked in DeFi has grown 60%, from 2.6 million to 4.2 million ETH. Azamat Malaev, founder of HodlTree, a new DeFi procedure for interest-yielding symbols, stated the driver for this development was investors securing crypto with a particular large DeFi lending institution to achieve “yield” or revenue.