Nonetheless, the comparison between China welcoming open-source, permissionless systems as well as the current U.S. government’s tendency towards anti-science insularity, authoritarianism and cronyism is telling.

One is thinking outside the box. The various other does not know it’s in a box.

Story this week: Which one is the centrally handled police state? Which one is the pro-innovation territory welcoming open-source modern technologies and also decentralized administration networks?

OK. I’m being a little sarcastic. The fact is Chinese President Xi Jinping has badly focused power. As a whole, his federal government, with its Hong Kong crackdown as well as Uighur detention camps, has encroached upon people’s flexibilities more than at any time considering that Mao Zedong’s policy. The default presumption must be that China’s blockchain vision favors cryptographic backdoors, centralized master tricks and also purchase tracking systems extra than it does the permissionless, censorship-resistant suitables of those six blockchains– Ethereum, Tezos, NEO, Nervos, EOS and IRISnet.

The long video game

China’s moves are consistent with its wish to challenge U.S. economic hegemony, an effort that focuses on its forthcoming electronic currency task, referred to as Digital Currency Electronic Payments, or DCEP.

The BSN, which will provide tools and also organizing solutions to programmers of blockchain-based applications targeted at Chinese development objectives, will at some point integrate DCEP. That will certainly bring the effectiveness of programmable fiat money right into top-priority usage instances such as decentralized supply chains and also wise city applications.

Broadening the series of blockchain methods incorporating DCEP will certainly allow the Chinese government to spread fostering of its electronic currency, assisting China difficulty Washington’s gatekeeping function in international money.

( To be clear, I see really little possibility of a digital renminbi coming to be a dollar-like international shop of value for reserve banks. Rather, the DCEP’s programmable top qualities can render redundant the very need for a reserve currency intermediary in worldwide purchases, permitting cross-border users to bypass the U.S. financial system.).

This comes as Chinese entities are seeking to prevent U.S. financial oversight in various other means.

Ant Group, which runs Alibaba’s Alipay mobile repayments system, this week announced its public listing will certainly occur in Shanghai and also Hong Kong however not New York.

This is a big deal. Alibaba is signifying a giant $200 billion valuation for Ant, whose Alipay solution represent over half of Chinese mobile repayments, which are forecast to strike RMB 777 trillion ($ 108 trillion) in 2020. U.S.-based capitalists will currently be denied access to this beast key share offering.

Why would certainly Alibaba, which in 2014 held its very own record-breaking $25 billion IPO on the New York Stock Exchange, take this step?

For answers, seek to Beijing as well as its tit-for-tat mini-Cold War with Washington.

With the Trump Administration pressuring the U.K. right into joining its ban versus Chinese mobile company Huawei’s 5G wireless service as well as closing China’s Houston consular office on accusations of trade secrets burglary, Xi’s government remains in retaliation mode.

Excluding the Wall Street facility from Ant’s bargain is one way of retaliating. Much more importantly, by getting rid of the Securities as well as Exchange Commission oversight of the business’s operations, it removes a lever U.S. regulators would certainly or else have over China’s payment systems.

The DCEP’s programmable top qualities might make redundant the extremely require for a reserve money intermediary in global deals.

Ant is likely to play a circulation role for the DCEP. It’s also large in the non-monetary world of blockchain; this week, Ant announced that users of its blockchain service, soon to be relabelled Airchain, are uploading 100 million digital possessions a day– primarily documents of transactions, residential property and also copyright cases. Leaving out the company from SEC oversight follows China’s resistance to permitting the U.S. any kind of gatekeeping ability over future blockchain-based settlements as well as worth exchange systems.

Till the electronic possessions age, the U.S. appreciated distinctively prominent powers over the exchange of analog money as well as building around the globe. This got on account of the dollar’s reserve status, which indicated the currency negotiation in any type of international exchange usually moved via a U.S.-regulated bank. China’s blockchain-integrated electronic settlements system might bring an end to that period.

The Hong Kong play.

Ant’s listing method will certainly also instill severely needed funds into Hong Kong, where demonstrations over China’s brand-new safety and security regulations have left lots of questioning the future of the international business headquartered there.

This brings us to the various other U.S.-China monetary flashpoint– the Hong Kong buck– as well as whether China’s accept of public blockchains might help it preserve this important resource of economic stability.

Hong Kong.

When the Trump Administration quickly considered undermining the Hong Kong buck’s secure to the U.S. buck, some CoinDesk editors discussed whether it was also possible. We wrapped up that while the U.S. can not straight refute the Hong Kong Monetary Authority (HKMA) access to its onshore foreign money gets– the backstop that guarantees the neighborhood money’s taken care of U.S. dollar value– it could hinder their blood circulation by getting U.S. reporter financial institutions not to transact with Hong Kong financial institutions.

That led us to question just how a China-led HKMA could keep its peg even if U.S. financial institutions were blocking Hong Kong banks. The feasible answer: blockchain-based stablecoins.

Hong Kong banks might utilize their residential holdings of U.S. buck gets to back a stable-value token that circulates in between blockchain addresses anywhere, all without U.S. financial institution intermediation. China would certainly make those tokens interoperable with DCEP electronic money.

I’ve no understanding such estimations lie behind China’s welcome of public blockchains. Yet provided the surge in Ethereum’s stablecoin transactions (see the “Global Town Hall” area below), Beijing definitely has its eyes on the field. Stablecoins might offer an avenue for China to accomplish financial autonomy without ruining the region’s monetary order.

The irony: China’s capability to escape U.S. control over a centrally taken care of digital currency, one that many anxiety will come to be a security device, could rely on decentralized systems.

Is the U.S. awake to what all this means?

People like Christopher Giancarlo, previous Chairman of the Commodity Futures Trading Commission, that this week once more testified to Congress on his Digital Dollar Project, are attempting to urge a counteractive technological campaign from Washington.

It’s not clear the message is sinking in.

Product symbols’ minute.

In assuming concerning exactly how to value brand-new forms of money, it’s helpful to think about exactly how individuals worth old kinds of money. Remarkably, there are modest parallels in the connection in between bitcoin, often related to as a “electronic gold” shop of worth, as well as “altcoins,” some of which are typically explained as “commodity-like” network symbols.

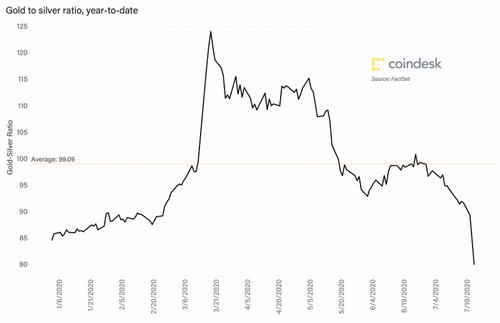

In contrast to a rather simplistic view of gold as an inflation hedge, this analysis views it a lot more extensively as a safe haven when investors end up being bearish concerning the state of the economic climate, which is what occurred in March with the start of the COVID-19 worldwide lockdown as well as market panic. Although this caused assumptions of deflation, gold rallied after an initial decrease as the level of the economic disaster embeded in as well as worries grew about the political failings. However extra just recently, as reserve bank stimulus has breathed life back right into stock markets and as European and also Asian economies have progressively reopened, expectations for a credit-fueled rebound sought after for products, as well as concurrently, in inflation, have expanded, even as the pandemic has actually spread out even more through the U.S. Hence silver’s current outperformance.

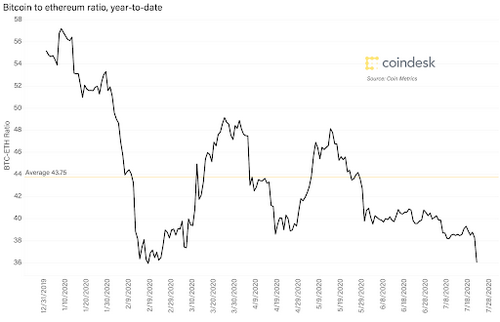

Interestingly, there’s a mirrored trend in bitcoin’s efficiency versus a number of altcoins. The outperformance has been particularly noticable for tokens such as Cardano’s ADA and Chainlink’s LINK, but it’s additionally obvious in the timeless dichotomy of bitcoin vs Ethereum’s ether.

Whereas several crypto area hard money supporters explained bitcoin’s spring healing from its March lows as a function of climbing inflation concerns– caught in the “Money printer go brrrrr” meme– I think it showed a similar “hell-in-a-handbasket” profession to that of gold. Currently, with liquidity sloshing around the crypto economic climate (itself an overflow from the Fed’s injections right into the fiat currency economic climate), speculators are looking at rising demand for DeFi debt products and also enhancing sentiment around brand-new blockchain- as well as smart-contract based tasks such as China’s.

I’m not wedded to this evaluation. Just thought it was enjoyable. Open up to critiques of it. Contend me.

International city center.

WOOD MONEY. “Yeah. ‘What is business economics?'” Fournier laughed. “I’m a firemen. I’m not an accounting professional, I’m not a, you know, I presume I’m a mayor, you know?”– CBS News, July 19.

We reported three months back on the little Italian community of Castellino del Biferno choosing to print its own money to restore monetary liquidity after the COVID-19 pandemic caused a deflationary contraction. Currently in Tenino, Washington (populace 1,884), Mayor Wayne Fournier is taking similar activities. In Tenino’s case, it’s cranking up an 1890 printing press that’s creating a throwback: local currency made out of timber.

The suggestion behind area currencies, which lock costs within the neighborhood economic situation, is not one-of-a-kind to the COVID-19 period. There were already greater than one hundred such systems of exchange around the U.S. alone. But desperate times are requiring creative thinking around money. People like this firefighter mayor as well as his neighbors are influenced to contemplate what money stands for as well as how its design and monitoring have social effects.

Tenino bucks

SETTLEMENT SUCCESS: One of the difficulties for widespread approval of blockchain technology lies in taxonomy: how we describe what it is and also what it does. These unprecedented new designs of value exchange do not offer themselves to clear examples, which means people misconstrue them. It’s excellent to see a wise take from Ryan Watkins over at Messari, a research firm, that is asking financiers to think differently concerning what blockchains in fact do prior to they leap to final thoughts concerning their success in assisting in payments.

Rather than holding bitcoin to a “you can not buy a cup of coffee” test, in which its little purchase stability is undermined by unpredictable BTC currency exchange rate and high purchase fees, Watkins describes blockchains as the negotiation layer to assist in larger-scale settlement flows. A much better contrast than cash, he claims, is Fedwire, the Federal Reserve’s system that permits banks to settle their equilibriums with each other. Bitcoin and Ethereum are on track to resolve a document $1.3 billion in mixed worth in 2020, the 3rd consecutive trillion dollar-plus year, a success by any kind of procedure. A big chunk of that is driven by rising stablecoin purchases on Ethereum, which must go beyond half a trillion bucks in worth this year, putting it in striking series of the $712 billion in settlements PayPal worked out in 2014. Blockchains do far more than simply allow fiat transfers; they offer an entire layer of negotiation performance that’s giving rise to an alternate financial system. Difficult to call this a failure.

In that capillary, a friendly discussion, caused by last week’s Twitter hack, saw Coin Center Executive Director Jerry Brito line up against Castle Island Ventures partner Nic Carter. Carter set it off with his thesis, laid out in one of his normal CoinDesk columns, that possession legal rights over Twitter accounts should build up to customers, not the company. His anti-deplatforming point was that customers develop most of the worth affixed to their manages with their posts and communications, and that this establishes a kind of electronic building that can not be taken from them.

Whichever debate would win in court, the dispute– which was extended by Carter’s “defense to the reply” on (where else but) Twitter– assists frame the discussion about just how to develop a far better social media sites system. The bottom line, and both Carter and also Brito agree on this, is that centralized social media platforms have done fantastic damage. We are way past due for a model that provides customers’ autonomy over their material and information, all connected to a clearly specified idea of self-sovereign, electronic identity.

Omitting the firm from SEC oversight is regular with China’s resistance to permitting the U.S. any kind of gatekeeping capacity over future blockchain-based payments and value exchange systems.

Up until the digital assets age, the U.S. took pleasure in distinctively influential powers over the exchange of analog money as well as residential or commercial property around the globe. Extra just recently, as main financial institution stimulation has taken a breath life back right into stock markets and as European as well as Asian economic situations have actually slowly reopened, assumptions for a credit-fueled rebound in need for commodities, as well as concurrently, in inflation, have actually expanded, also as the pandemic has actually spread additionally through the U.S. Hence silver’s recent outperformance.

Currently, with liquidity sloshing around the crypto economy (itself an overflow from the Fed’s injections into the fiat currency economy), speculators are looking at rising need for DeFi credit report items and also improving belief around new blockchain- and smart-contract based projects such as China’s. There were currently even more than one hundred such units of exchange around the U.S. alone.