A Political Circus. This month’s market turbulence came amid growing concerns about the US Congress’s failure to pass a new coronavirus stimulus package.

Earlier this month, the Republican side attempted to pass a smaller bill. But as the relief did not include a $1,200 check, the Democrats rejected the proposal entirely.

Still, the Democrats pushed back on the stimulus checks during a hearing with the Fed chairman Jerome Powell and Treasury Secretary Steven Mnuchin this Tuesday.

Mr. Powell clarified to the committee that the Congress will have to intervene with the second stimulus package if they don’t want to stall the ongoing US economic recovery. He noted that the Fed cannot assume the responsibility of distributing checks to Americans all by itself.

“The risk is that over time [the unemployed] go through those savings . . . their spending will decline, their ability to stay in their homes will decline, so the economy will begin to feel those negative effects at some time,” he told the Democrats. “I think that it is likely that more fiscal support will be needed.”

But with the ongoing standoff, observers believe it is now very unlikely for Congress to pass the stimulus deal. The chances have diminished also by political tensions ahead of the US presidential election on November 3, 2020.

Both Democrats and Republicans will attempt to score political mileage over each other to score votes out of frustrated Americans. That said, one can expect no stimulus bill until the US votes for its next president: Donald Trump or Joe Biden.

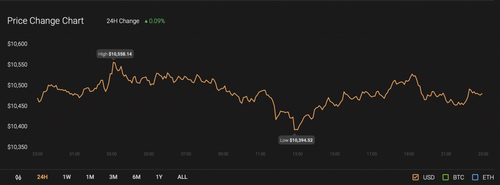

For months, the Bitcoin price rose this year – regardless of a fast-spreading pandemic, the resulting economic turmoil, and poor evaluations by the mainstream media houses. Then, in September, the cryptocurrency came crashing down.

It was March 2020 all over again, minus severity. Bitcoin established a year-to-date high near $12,500, started correcting lower on profit-securing sentiment, but accelerated its bearish momentum alongside a similar correction in the stock and gold markets.

The narrative goes like this: equities fall hard; the loss-making traders start selling their gold and bitcoin investments at their local tops to cover losses; the US dollar rises, and repeat.

One also has to remember that traders dumped their Bitcoin positions against a very bullish macro outlook. The Federal Reserve committed to keeping interest rates near zero up until 2023. Their chairman Jerome Powell vowed to push inflation higher above the normal 2 percent target. And the US Congress hoped to inject more dollar liquidity into the economy through a second stimulus package.

But Bitcoin fell, nevertheless, because one of the main catalysts did not play out as planned: the stimulus.

The US Dollar and Bitcoin

The absence of a stimulus package is trimming gains all across the financial market, including that of Bitcoin. But what is benefiting out of the political uncertainty is the US dollar.

The greenback jumped to its eight-week high as investors treated it as their safest haven asset. The lack of a stimulus bill ensures that there would be less dollar liquidity in the market. Therefore, investors may have decided to lock their profits in the cash until further clarity.

Bitcoin has shown a strong inverse correlation with the US dollar since March 2020. The cryptocurrency could therefore continue plunging as the greenback rises against the stimulus backdrop.

– S&P500 ???? is signaling a short term bearish reversal continuing the Macro bearish reversal

– NASDAQ ???? may lead the market down, FinTech stocks are over-leveraged

– U.S. Dollar Index ???? now breaking out into new local highs

– GOLD testing support????

– #Bitcoin bearish setup

— Kevin Svenson (@KevinSvenson_) September 23, 2020

That ensures that BTC/USD is not hitting $20,000 – let alone its 2019 high of $14,000 – until the US presidential election. At best, it could hold support above $9,000 while anticipating a jump after the political battle is over.

My name’s Eric and I just found your site bloomerg.ru.

It’s got a lot going for it, but here’s an idea to make it even MORE effective.

Talk With Web Visitor is a software widget that’s works on your site, ready to capture any visitor’s Name, Email address and Phone Number. It signals you the moment they let you know they’re interested – so that you can talk to that lead while they’re literally looking over your site.

And once you’ve captured their phone number, with our new SMS Text With Lead feature, you can automatically start a text (SMS) conversation… and if they don’t take you up on your offer then, you can follow up with text messages for new offers, content links, even just “how you doing?” notes to build a relationship.