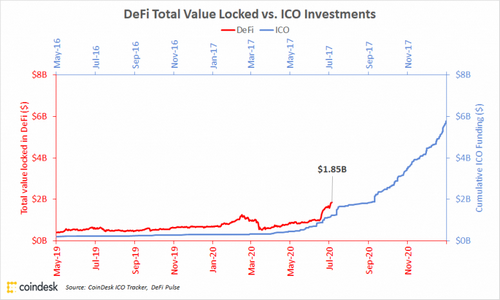

According to DeFi Pulse, there is $1.9 billion in crypto properties locked in DeFi today. According to the CoinDesk ICO Tracker, the ICO market began downing previous $1 billion in July 2017, just a couple of months before token sales began obtaining spoken about on television.

It’s properly July 2017 in the globe of decentralized financing (DeFi), and also as in the stimulating days of the first coin offering (ICO) boom, the numbers are only trending up.

Argument juxtaposing these numbers if you like, however what no one can question is this: Crypto individuals are placing extra and extra value to function in DeFi applications, driven greatly by the introduction of a whole new yield-generating field, Compound’s COMP governance token.

Governance tokens enable users to vote on the future of decentralized protocols, sure, however they also existing fresh ways for DeFi founders to lure properties onto their systems.

That said, it’s the crypto liquidity suppliers who are the celebrities of the existing minute. They also have a meme-worthy name: yield farmers.

DeFi TVL (2019-20) vs. ICO financial investments (2016-17)

Where it began

Ethereum-based credit scores market Compound started distributing its administration token, COMP, to the method’s customers this previous June 15. Need for the token (enhanced by the means its automatic distribution was structured) began the here and now craze and also relocated Compound right into the leading position in DeFi.

The hot brand-new term in crypto is “yield farming,” a shorthand for smart strategies where placing crypto momentarily at the disposal of some startup’s application earns its proprietor much more cryptocurrency.

An additional term drifting around is “liquidity mining.”

The buzz around these ideas has actually advanced into a low rumble as a growing number of people obtain interested.

When task warms up might be starting to obtain faint vibes that something is occurring right currently, the laid-back crypto observer who just pops right into the market. Take our word for it: Yield farming is the resource of those vibes.

If all these terms (” DeFi,” “liquidity mining,” “return farming”) are so much Greek to you, fear not. We’re below to capture you up. We’ll enter all of them.

We’re mosting likely to go from really fundamental to advanced, so feel cost-free to skip in advance.

What are tokens?

A lot of CoinDesk readers most likely know this, but just in case: Tokens resemble the cash video-game players make while dealing with beasts, money they can utilize to buy gear or weapons in the world of their preferred game.

However with blockchains, symbols aren’t limited to only one greatly multiplayer online money game. They can be earned in one and also made use of in lots of others. They generally represent either ownership in something (like an item of a Uniswap liquidity swimming pool, which we will certainly get into later) or accessibility to some service. For instance, in the Brave internet browser, ads can just be gotten utilizing fundamental attention token (BAT).

If tokens deserve money, after that you can bank with them or at the very least do points that look quite like financial. Thus: decentralized finance.

Symbols showed to be the big usage instance for Ethereum, the second-biggest blockchain on the planet. The regard to art right here is “ERC-20 tokens,” which describes a software application criterion that permits token designers to write policies for them. Tokens can be utilized a couple of means. Frequently, they are utilized as a form of money within a set of applications. The idea for Kin was to produce a token that web individuals could spend with each other at such tiny quantities that it would virtually feel like they weren’t spending anything; that is, money for the web.

Administration symbols are different. They are not like a token at a video-game game, as many tokens were described in the past. They work a lot more like certifications to serve in an ever-changing legislature in that they offer holders the right to vote on adjustments to a protocol.

So on the platform that confirmed DeFi could fly, MakerDAO, holders of its governance token, MKR, vote nearly weekly on little changes to criteria that control just how much it sets you back to obtain and exactly how much savers make, and more.

Something all crypto symbols share, though, is they are tradable as well as they have a cost. So, if symbols deserve money, then you can bank with them or at the very least do things that look extremely a lot like financial. Therefore: decentralized financing.

What is DeFi?

Fair question. For people that disregarded awhile in 2018, we made use of to call this “open financing.” That construction appears to have discolored, however, as well as “DeFi” is the new language.

If doesn’t run your memory, DeFi is all things that let you have fun with cash, and also the only recognition you require is a crypto budget.

On the normal internet, you can’t get a mixer without offering the site proprietor enough data to discover your whole biography. In DeFi, you can obtain cash without any person also requesting your name.

I can explain this but nothing truly brings it residence like attempting one of these applications. If you have an Ethereum budget that has also $20 worth of crypto in it, go do something on one of these items. Pop over to Uniswap and also get on your own some FUN (a token for wagering apps) or WBTC (covered bitcoin). Most likely to MakerDAO as well as produce $5 worth of DAI (a stablecoin that has a tendency to be worth $1) out of the electronic ether. Most likely to Compound and also obtain $10 in USDC.

( Notice the extremely percentages I’m suggesting. The old crypto saying “don’t put in greater than you can afford to lose” goes double for DeFi. This stuff is uber-complex and also a great deal can go incorrect. These may be “financial savings” products yet they’re not for your retirement financial savings.).

Experimental and also immature though it may be, the modern technology’s ramifications are startling. On the normal web, you can’t get a blender without offering the website owner sufficient information to discover your whole life background. In DeFi, you can obtain cash without anybody also requesting your name.

DeFi applications do not bother with trusting you since they have the collateral you put up to back your financial debt (on Compound, as an example, a $10 financial obligation will certainly need around $20 in collateral).

Note that you can exchange all these points back as soon as you’ve taken them out if you do try and also take this advice something. Open the finance and close it 10 mins later. It’s great. Fair warning: It might cost you a little bit in charges, and the expense of making use of Ethereum itself today is much higher than typical, in component due to this fresh new activity. It’s nothing that needs to spoil a crypto customer.

So what’s the factor of loaning for individuals who already have the cash? Most individuals do it for some sort of profession. The most obvious example, to short a token (the act of benefiting if its rate falls). It’s likewise great for a person that wants to keep a token yet still play the market.

Does not running a financial institution take a great deal of cash up front?

It does, as well as in DeFi that money is mostly given by strangers on the web. That’s why the start-ups behind these decentralized financial applications come up with clever methods to bring in HODLers with still possessions.

Liquidity is the chief issue of all these various products. That is: How much cash do they have secured their wise agreements?

” In some sorts of items, the product experience gets far better if you have liquidity. As opposed to loaning from VCs or debt investors, you borrow from your individuals,” said Electric Capital taking care of partner Avichal Garg.

Allow’s take Uniswap as an instance. Uniswap is an “computerized market maker,” or AMM (an additional DeFi regard to art). This means Uniswap is a robotic online that is always ready to get and also it’s likewise constantly ready to offer any type of cryptocurrency for which it has a market.

On Uniswap, there is at the very least one market pair for practically any kind of token on Ethereum. Behind the scenes, this means Uniswap can make it look like it is making a straight trade for any kind of 2 tokens, that makes it very easy for users, but it’s all constructed around swimming pools of two tokens. And also all these market pairs work better with larger pools.

Why do I keep listening to about ‘swimming pools’?

To show why even more money helps, let’s damage down exactly how Uniswap functions.

Allow’s claim there was a market for USDC as well as DAI. These are 2 symbols (both stablecoins however with different systems for retaining their value) that are indicated to be worth $1 each regularly, as well as that normally often tends to be true for both.

The cost Uniswap shows for each token in any pooled market set is based upon the balance of each in the pool. Simplifying this a whole lot for picture’s benefit, if someone were to establish up a USDC/DAI swimming pool, they should transfer equivalent amounts of both. In a swimming pool with only 2 USDC and also 2 DAI it would certainly provide a cost of 1 USDC for 1 DAI. After that think of that someone put in 1 DAI as well as took out 1 USDC. Then the pool would certainly have 1 USDC and also 3 DAI. The pool would be extremely out of order. A smart capitalist could make a very easy $0.50 earnings by placing in 1 USDC and also obtaining 1.5 DAI. That’s a 50% arbitrage profit, and that’s the trouble with restricted liquidity.

( Incidentally, this is why Uniswap’s prices often tend to be exact, because investors watch it for little discrepancies from the larger market as well as trade them away for arbitrage earnings extremely quickly.).

If there were 500,000 USDC and also 500,000 DAI in the pool, a trade of 1 DAI for 1 USDC would have a minimal effect on the relative cost. That’s why liquidity is helpful.

You can stick your properties on Compound as well as gain a little yield. That’s not very innovative. Customers that search for angles to make the most of that return: those are the yield farmers.

Comparable results hold across DeFi, so markets want even more liquidity. This advantages liquidity companies since when someone places liquidity in the swimming pool they have a share of the pool.

And this brings us back to tokens.

Liquidity added to Uniswap is stood for by a token, not an account. Bob simply has a token in his pocketbook. And also Bob does not have to maintain that token.

Exactly how much money do individuals make by placing money right into these items?

It can be a great deal more financially rewarding than putting money in a traditional financial institution, which’s before startups began giving out governance symbols.

Compound is the present darling of this area, so let’s use it as an image. As of this writing, a person can put USDC into Compound and earn 2.72% on it. They can put secure (USDT) into it and also earn 2.11%. A lot of U.S. checking account make less than 0.1% nowadays, which is close adequate to nothing.

Nevertheless, there are some cautions. There’s a factor the rate of interest prices are so much juicier: DeFi is a much riskier place to park your cash. There’s no Federal Deposit Insurance Corporation (FDIC) shielding these funds. If there were a work on Compound, individuals can find themselves incapable to withdraw their funds when they desired.

And also, the passion is quite variable. You don’t know what you’ll gain throughout a year. USDC’s rate is high now. It was low last week. Generally, it hovers somewhere in the 1% range.

In a similar way, a user might obtain attracted by properties with more profitable yields like USDT, which usually has a much greater rates of interest than USDC. (Monday early morning, the opposite was real, for vague factors; this is crypto, remember.) The trade-off right here is USDT’s openness concerning the real-world dollars it’s supposed to hold in a real-world bank is not almost up to par with USDC’s. A difference in rate of interest is typically the market’s method of telling you the one tool is considered as dicier than another.

Customers making large bank on these products count on firms Opyn and Nexus Mutual to insure their positions since there’s no federal government securities in this nascent room– extra on the enough dangers later on.

Individuals can stick their possessions in Compound or Uniswap and gain a little yield. That’s not really creative. Individuals who try to find angles to make the most of that yield: those are the return farmers.

OK, I already recognized all of that. What is return farming?

Extensively, return farming is any initiative to put crypto possessions to function and also produce the most returns feasible on those properties.

At the easiest degree, a return farmer might relocate properties around within Compound, constantly chasing whichever pool is supplying the most effective APY from week to week. This might indicate relocating right into riskier pools periodically, but a return farmer can deal with danger.

” Farming opens up brand-new price arbs [arbitrage] that can overflow to various other methods whose symbols remain in the swimming pool,” stated Maya Zehavi, a blockchain professional.

Due to the fact that these placements are tokenized, though, they can go better.

This was a brand-new sort of return on a down payment. Actually, it was a means to gain a yield on a lending. That has ever before come across a customer making a return on a financial obligation from their lender?

In a simple example, a return farmer could place 100,000 USDT into Compound. They will certainly get a token back for that risk, called cUSDT. Allow’s claim they get 100,000 cUSDT back (the formula on Compound is insane so it’s not 1:1 like that but it does not matter for our functions here).

They can after that take that cUSDT as well as placed it right into a liquidity swimming pool that takes cUSDT on Balancer, an AMM that allows customers to establish up self-rebalancing crypto index funds. The user looks for side situations in the system to eke out as much yield as they can across as several products as it will certainly function on.

Now, nevertheless, points are not normal, and they possibly won’t be for a while.

Why is return farming so hot now?

Since of liquidity mining. Liquidity mining supercharges yield farming.

Liquidity mining is when a return farmer gets a new token as well as the usual return (that’s the “mining” component) for the farmer’s liquidity.

” The idea is that boosting use of the platform increases the value of the token, consequently producing a favorable use loophole to bring in customers,” said Richard Ma of smart-contract auditor Quantstamp.

The return farming examples over are only farming yield off the regular operations of various systems. Supply liquidity to Compound or Uniswap and also obtain a little cut of the organization that runs over the protocols– extremely vanilla.

Substance introduced earlier this year it wanted to really decentralize the product and also it desired to give an excellent amount of ownership to the people that made it preferred by utilizing it. That ownership would certainly take the kind of the COMP token.

Lest this noise as well selfless, remember that the individuals who produced it (the group and also the financiers) owned majority of the equity. By handing out a healthy percentage to individuals, that was very most likely to make it a lot more prominent area for borrowing. Subsequently, that would certainly make everybody’s risk well worth much extra.

So, Compound introduced this four-year duration where the procedure would certainly provide out COMP tokens to customers, a fixed quantity daily till it was gone. These COMP symbols regulate the protocol, equally as investors inevitably manage publicly traded business.

On a daily basis, the Compound method takes a look at everyone that had actually provided money to the application and also who had obtained from it and gives them COMP symmetrical to their share of the day’s overall organization.

The results were really shocking, also to Compound’s greatest promoters.

Compensation’s value will likely go down, as well as that’s why some investors are hurrying to gain as much of it as they can today.

This was a new type of yield on a down payment right into Compound. Actually, it was a way to make a yield on a loan, as well, which is really odd: Who has ever heard of a consumer making a return on a financial debt from their lender?

Compensation’s worth has actually constantly been well over $200 since it began dispersing on June 15. We did the math somewhere else yet long tale brief: financiers with rather deep pockets can make a solid gain optimizing their daily returns in COMP. It is, in a method, free money.

It’s feasible to provide to Compound, borrow from it, down payment what you borrowed and more. This can be done multiple times and DeFi start-up Instadapp even built a tool to make it as capital-efficient as feasible.

” Yield farmers are incredibly creative. They locate ways to ‘stack’ yields as well as also gain multiple governance tokens at once,” claimed Spencer Noon of DTC Capital.

COMP’s worth spike is a temporary circumstance. The COMP circulation will just last four years and after that there will not be any even more. Additionally, lots of people agree that the high price now is driven by the reduced float (that is, just how much COMP is really totally free to trade on the market– it will never ever be this low once more). So the worth will most likely progressively go down, which’s why smart investors are trying to gain as long as they can now.

Attracting the speculative instincts of diehard crypto investors has verified to be a terrific method to boost liquidity on Compound. This plumps some pockets however also improves the customer experience for all kinds of Compound users, including those that would utilize it whether they were mosting likely to earn COMP or not.

As usual in crypto, when entrepreneurs see something effective, they copy it. Balancer was the next method to start distributing a governance token, BAL, to liquidity providers. Blink financing supplier bZx has revealed a strategy. Ren, Curve and Synthetixalso collaborated to advertise a liquidity swimming pool on Curve.

It is a reasonable wager much of the even more popular DeFi projects will certainly reveal some kind of coin that can be extracted by providing liquidity.

The situation to see right here is Uniswap versus Balancer. Balancer can do the very same thing Uniswap does, yet the majority of individuals that wish to do a quick token trade via their purse use Uniswap. It will certainly interest see if Balancer’s BAL token persuades Uniswap’s liquidity suppliers to issue.

Up until now, though, more liquidity has entered into Uniswap given that the BAL news, according to its information site. That claimed, much more has entered into Balancer.

Did liquidity mining start with COMP?

No, yet it was the most-used method with one of the most thoroughly made liquidity mining scheme.

This point is debated however the origins of liquidity mining probably go back to Fcoin, a Chinese exchange that developed a token in 2018 that awarded people for making trades. You will not think what happened next! Simply joking, you will: People simply started running bots to do pointless professions with themselves to make the token.

Similarly, EOS is a blockchain where transactions are basically totally free, however because absolutely nothing is actually cost-free the lack of friction was an invitation for spam. Some malicious hacker that really did not like EOS created a token called EIDOS on the network in late 2019. It awarded people for lots of meaningless purchases and in some way got an exchange listing.

These efforts highlighted just how swiftly crypto individuals reply to rewards.

Fcoin apart, liquidity mining as we currently understand it very first appeared on Ethereum when the marketplace for artificial tokens, Synthetix, announced in July 2019 an award in its SNX token for customers that aided include liquidity to the sETH/ETH swimming pool on Uniswap. By October, that was just one of Uniswap’s largest pools.

When Compound Labs, the company that launched the Compound procedure, determined to create COMP, the governance token, the company took months developing simply what type of actions it wanted and exactly how to incentivize it. Even still, Compound Labs was stunned by the reaction. It brought about unexpected consequences such as crowding into a previously unpopular market (lending as well as loaning BAT) in order to extract as much COMP as possible.

Simply last week, 115 different COMP purse addresses– legislators in Compound’s ever-changing legislature– elected to transform the distribution mechanism in hopes of spreading out liquidity out throughout the markets once more.

Exists DeFi for bitcoin?

Yes, on Ethereum.

Nothing has defeated bitcoin gradually for returns, however there’s one point bitcoin can’t do on its very own: develop more bitcoin.

A smart trader can enter and out of bitcoin and also bucks in a way that will certainly make them even more bitcoin, however this is laborious and dangerous. It takes a certain type of person.

DeFi, nonetheless, provides ways to grow one’s bitcoin holdings– though rather indirectly.

A long HODLer is happy to get fresh BTC off their counterparty’s temporary win. That’s the video game.

A customer can create a substitute bitcoin on Ethereum utilizing BitGo’s WBTC system. They placed BTC in and also get the exact same amount back out in freshly produced WBTC. WBTC can be traded back for BTC at any type of time, so it often tends to be worth the very same as BTC.

The user can take that WBTC, risk it on Compound as well as gain a few percent each year in yield on their BTC. Chances are, individuals who borrow that WBTC are most likely doing it to short BTC (that is, they will market it right away, buy it back when the rate decreases, close the car loan as well as keep the difference).

A lengthy HODLer mores than happy to acquire fresh BTC off their counterparty’s temporary win. That’s the video game.

The term of art right here is “ERC-20 symbols,” which refers to a software program requirement that permits token developers to create rules for them. They are not like a token at a video-game arcade, as so numerous tokens were explained in the past. Behind the scenes, this suggests Uniswap can make it look like it is making a direct trade for any kind of two symbols, which makes it simple for users, but it’s all built around swimming pools of two tokens. Liquidity added to Uniswap is stood for by a token, not an account. It will be intriguing to see if Balancer’s BAL token convinces Uniswap’s liquidity suppliers to issue.

Just how risky is it?

” DeFi, with the combination of a variety of digital funds, automation of key processes, and also more complicated incentive structures that function across protocols– each with their very own quickly transforming tech and governance methods– create new sorts of protection dangers,” said Liz Steininger of Least Authority, a crypto security auditor. “Yet, despite these risks, the high yields are unquestionably eye-catching to draw more individuals.”

We’ve seen big failures in DeFi items. MakerDAO had one so negative this year it’s called “Black Thursday.” There was additionally the manipulate against flash financing carrier bZx. These things do damage and also when they do cash obtains taken.

As this field obtains even more durable, we can see token owners greenlighting even more means for investors to benefit from DeFi particular niches.

Currently, the deal is too excellent for specific funds to stand up to, so they are relocating a whole lot of money into these procedures to liquidity mine all the new governance symbols they can. The funds– entities that pool the resources of generally well-to-do crypto capitalists– are additionally hedging. Nexus Mutual, a DeFi insurance coverage supplier of sorts, told CoinDesk it has actually maxed out its readily available coverage on these liquidity applications. Opyn, the trustless by-products manufacturer, produced a method to short COMP, just in instance this game comes to naught.

And also weird points have occurred. There’s presently more DAI on Compound than have been minted in the globe. Once unpacked however it still feels dicey to every person, this makes sense.

That claimed, dispersing governance symbols could make points a great deal less risky for start-ups, at the very least with regard to the money police officers.

(The Simple Agreement for Future Tokens was a legal structure preferred by numerous token companies during the ICO trend.).

Whether a cryptocurrency is effectively decentralized has been a key attribute of ICO negotiations with the U.S. Securities and also Exchange Commission (SEC).

What’s following for yield farming? (A prediction).

Compensation transformed out to be a bit of a surprise to the DeFi globe, in technological ways as well as others. It has actually influenced a wave of brand-new reasoning.

” Other projects are dealing with comparable things,” stated Nexus Mutual creator Hugh Karp. Notified sources tell CoinDesk brand-new tasks will certainly introduce with these models.

We could quickly see even more prosaic yield farming applications. Types of profit-sharing that compensate particular kinds of actions.

Think of if COMP owners made a decision, for example, that the protocol needed more individuals to place cash in as well as leave it there longer. The community might create a proposition that cut off a little of each token’s yield as well as paid that part out just to the tokens that were older than six months. It probably wouldn’t be a lot, however a capitalist with the right time horizon as well as risk profile could take it right into consideration before making a withdrawal.

( There are criteria for this in conventional financing: A 10-year Treasury bond normally generates greater than a one-month T-bill even though they’re both backed by the full confidence and credit report of Uncle Sam, a 12-month certificate of deposit pays greater interest than a checking account at the same financial institution, and so on.).

As this industry gets even more durable, its engineers will certainly generate ever before even more durable means to enhance liquidity rewards in increasingly fine-tuned means. We could see token owners greenlighting even more ways for financiers to benefit from DeFi specific niches.

Concerns abound for this nascent market: What will MakerDAO do to restore its spot as the king of DeFi? Will anyone stick all these administration symbols into a decentralized self-governing organization (DAO)?

Whatever occurs, crypto’s return farmers will certainly maintain scooting. Some fresh fields might open up as well as some might soon bear a lot less lush fruit.

That’s the great thing concerning farming in DeFi: It is extremely easy to switch over fields.

Now, the bargain is too good for certain funds to stand up to, so they are moving a great deal of cash into these methods to liquidity mine all the brand-new administration tokens they can. Nexus Mutual, a DeFi insurance service provider of sorts, told CoinDesk it has actually maxed out its offered insurance coverage on these liquidity applications. (The Simple Agreement for Future Tokens was a legal structure preferred by numerous token providers during the ICO craze.).

The community might produce a proposal that shaved off a little of each token’s yield and also paid that section out only to the tokens that were older than 6 months. Will anybody stick all these administration symbols right into a decentralized independent company (DAO)?