Now, I have no concept exactly how old you are, neither do I intend to make any assumptions. I will certainly assume, however, that because you are reading this, you have a passion in markets and/or crypto possessions.

And because this is an e-newsletter targeted at professional investors, I will certainly assume that you care about a bit greater than prices going up/down/sideways. That must place us on essentially the same page regarding what we check out right here.

Nevertheless, this week I desire us all to question the lens through which we evaluate the evolution of markets. Not simply crypto markets– all markets, since it is coming to be progressively clear that eventually the distinction will be pointless.

You’re reading Crypto Long & Short, a newsletter that looks closely at the pressures driving cryptocurrency markets. Authored by CoinDesk’s head of study, Noelle Acheson, it goes out every Sunday and also provides a recap of the week– with insights and evaluation— from an expert investor’s point of view. You can subscribe here.

What those markets look like is pertinent, however, and I am significantly conscious that my sight on that may be affected by my age. Could yours. It can be valuable, then– maybe even enjoyable if not a little discomforting– to try to see the advancement of markets from the viewpoint of a various generational label.

Right here’s an example: Many market onlookers, myself consisted of, have been commemorating the introduction of prime brokerage services that have clout and experience. The most up to date to join the growing checklist of heavyweights is London-based B2C2, which began offering OTC liquidity to crypto markets in 2015, as well as today announced a partnership with and also investment from Japanese monetary empire SBI Holdings which will allow it to relocate towards including prime solutions to its currently energetic circulation.

We’re thrilled about this due to the fact that it represents a growth of the crypto markets as well as eliminates among the substantial barriers separating organizations as well as crypto investment: the structural inefficiency of funding. Offered an option of crypto prime brokers with strong balance sheets, the reasoning goes, extra institutions will be ready to take part, as well as the increase of demand and also liquidity will certainly push up asset costs. A brand-new crypto market era might be dawning.

What if the genuine dawning is coming from an entirely different instructions? Suppose a cultural shift is emerging that could wind up reshaping conventional markets to look more like the crypto markets?

Youngsters

Generation Z is currently the biggest generation worldwide, accounting for almost 30% of the U.S. populace. They’re teenagers as well as in their early 20s, and many won’t be actively investing because of a lack of income as well as savings– however, according to surveys, they’re politically active as well as well-educated, and also have actually been given a loud wake-up call when it comes to the requirement to secure whatever wide range they might accumulate.

They are likewise electronic locals and, when they are old enough, will certainly see nothing unusual in designating their cost savings to possessions by means of swipes on their phones (or movements of their headsets or digital glasses, that knows). It is not likely they will discover the fragmented nature of crypto markets startling, and also the creativity of many crypto property items on the market today might attract their solid sense of uniqueness.

What’s even more, the young as well as future savers will certainly result investing age in possibly the worst recession in generations, with work safety at record lows, markets significantly divorced from basics as well as growing doubts regarding the resilience of fiat money. They will have lots of factor to doubt well established monetary wisdom, as well as a lot of possibility to discover new financial investment layouts.

Earlier this year, the Edelman Trust Barometer showed that self-confidence in federal governments, media and company goes to record lows, as well as that over half of respondents believe that capitalism is failing them. While the survey does not cover Generation Z (survey participants more than 25), it would be a stretch to assume that the young adults these days will arise from terminated classes as well as lockdown with their moms and dads with higher confidence in federal governments’ ability to safeguard them than their precursors have.

Transforming behaviors

Going up the age scale a bit, you’ll have seen the headings concerning the perceived influence millennials are having on the securities market through applications such as Robinhood. The day-trading frenzy may go away must costs crash, however the underlying gamification will probably produce financial investment habits that will certainly linger as a brand-new generation of financiers enters the market.

This will be supported by the continuing separation of market value from underlying value– why do financial investment homework when principles do not truly matter anymore?

What’s more, some experts assert that Generation Z is the DIY generation as well as is as a result less likely than even millennials to make use of the services of specialist investment consultants. YouTube, TikTok and social investment apps, where strategies are shared, provide enough opportunity to find out as well as resemble from others.

( For the record, I have a Gen Z little girl that was not specifically useful in my surface study– she would certainly never ever day trade, does not trust financial institutions as well as is delighted about her weak bitcoin financial investment which she keeps in a hardware purse. She has no suggestion what her pals believe concerning all this as well as would simply pass away of shame if I asked them.).

New markets.

So, incorporate a mistrust of centralized establishments with a high level of convenience with electronic systems and also a family member disrespect for traditional financial experience, and you have a generation with the possible to reword just how markets function.

This generation will emerge into a market in which standard financial investment requirements no much longer use, and for which words “extraordinary” has actually lost the majority of its significance. They will do so without the clear property distinction that their moms and dads and also older siblings have actually depended on to make portfolio choices.

Real, their integrated personal riches is likely to be small contrasted to the cash handled by typical institutions.

These organizations are hardly ever immune to traditional investment society. They run under various policies, with much less liberty as well as entrenched checks and also equilibriums. Most of them– pension funds, mutual fund managers, insurance policy firms– are there to offer retail capitalists. And their results will most likely be affected by the growing impact of retail capitalists on the market.

Crypto markets are most likely to increasingly look like conventional markets. What standard markets look like will certainly additionally evolve, possibly past existing recognition.

We could already be seeing indications of this taking place. Max Boonen, CEO of B2C2, the crypto OTC firm I pointed out previously, hinted that his firm was looking at trading other possessions alongside cryptocurrencies. The market get to that the alliance with SBI Holdings provides B2C2 will push this amalgam right into brand-new areas, prepared for a brand-new generation of financiers.

It doesn’t hurt that SBI is the largest on the internet brokerage in Japan, a nation with an active retail capitalist baseknown for its contrarian thinking. B2C2 will certainly promote the platform’s crypto property trades.

This will not just continue to obscure the lines between crypto and conventional property investing. It will certainly likewise proceed to obscure the lines between retail and also institutional rate of interest.

I, for one, plan to remain to get delighted around large progressions in the professionalization of crypto markets and in their interest institutional financiers.

I will certainly a lot more delight in, however, seeing the very nature of markets progress. And also I will be honored of the younger generation of financiers assisting to make this happen.

Any individual know what’s going on?

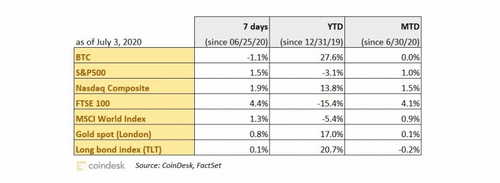

As the number of brand-new COVID-19 instances in the U.S. as well as around the globe reaches all-time highs, really hopes for a vaccination and also a quick financial recovery continue to press markets higher.

True, daily that passes puts us eventually closer to an injection being available for everybody. Yet in between once in a while, there’s a whole lot of hurt coming, and we have no concept what the last cost will be. And markets are acting like the price will be minimal.

Not all stocks are affected just as, nonetheless– the Nasdaq has now not just significantly outperformed the S&P 500 given that the start of the year, it has also gotten to all-time highs, exceeding also the dot-com bubble.

This stands for a widening gulf in between tech supplies as well as more conventional industries, along with a perilous change in corporate priorities. It’s nearly as if financiers are encouraging business to ignore the health of their annual report in favor of future incomes potential, specifically in a market that presumes that prospective defaults will certainly be released.

Bitcoin proceeds to sell a relatively limited array, which some claim is a timeless accumulation to a breakout. That may be the situation, but no one knows when that outbreak will take place, or, for that matter, in what instructions.

CHAIN LINKS.

SBI Holdings has actually taken a $30 million risk in crypto OTC firm B2C2. With B2C2’s execution track document as well as SBI’s accessibility to a range of other crypto asset services with various crypto industry financial investments, B2C2’s OTC customers might soon also be able to access a variety of assistance functions including leverage and protection. The connection will certainly additionally boost crypto trading solutions for customers of SBI Securities, one of Japan’s largest online broker agents.

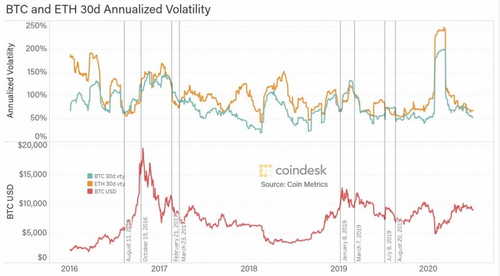

Bitcoin might appear to be a lot more unpredictable than standard assets however in crypto markets it is thought about reasonably stable contrasted to various other cryptocurrencies. That pricing circumstance may change throughout the 3rd quarter, according to choices market information, which suggests that BTC volatility will certainly be greater than that of ETH in coming months. Traditionally, other than for the late 2017 run-up, periods in which ETH’s volatility has actually gone beyond that of BTC have corresponded with depressions in BTC’s price.

Crypto expert as well as capitalist Chris Burniske assumed that, given the unrelenting increase of equity markets, we might well soon see a large crypto company go public– and that this would be a driver for higher mainstream passion in the sector. TAKEAWAY: It does seem possible, and might be a catalyst not just for mainstream passion, yet additionally for governing clearness from the SEC. Can’t have a splashy IPO for a business that operates in an industry whose regulatory future doubts, currently, can we?

Crypto data company Coin Metrics has actually exposed a brand-new approach for measuring the size and depth of digital possession markets, which includes leaving out coins and tokens that have been non-active for over 5 years. TAKEAWAY: Given that some protocols intentionally lock up coins for lengthy periods or have large founding treasuries, not all communities can successfully utilize market capitalization as a meaningful scale of size as well as depth.

Crypto data company Glassnode generated a detailed look at the current task of bitcoin whales( entities with at the very least 1,000 BTC). What’s more, the market share of these whales is seeing its largest sustained increase since 2011, after decreasing for nearly a years.

Bitcoin miner Hut 8 has elevated $8.3 million from marketing a 6% equity risk to investors, approximately $800,000 even more than the initial financing target. Unless the bitcoin price values dramatically in the short term, it’s possible that Hut 8 will still require to discover even more financing for a tools upgrade.

The stock-to-flow design that predicted solid cost admiration for bitcoin post-halving is not having its best moment.

Nico Cordeiro, CIO at fund manager Strix Leviathan, presents an in-depth analysis that mentions some basic imperfections as well as misconstrued meanings of the stock-to-flow design of bitcoin price forecast. He shows that it does not hold for gold, as well as inquiries the option prejudice that presumes it has actually held for bitcoin.

Eric Wall, the CIO of Arcane Assets, takes the reviews a step additionally, by listing the main debates versus the design made by analysts over the previous year.

The New York Digital Investment Group (NYDIG) has actually elevated an additional $190 million for a bitcoin fund called NYDIG Institutional Bitcoin Fund LP. TAKEAWAY: The raising is a hefty amount, specifically when integrated with the $140 million elevated by the company in May for its NYDIG Bitcoin Yield Enhancement Fund. Evidently the fresh raising was from 24 unnamed investors, which puts the ordinary financial investment of each at around $8 million– this signals a strong institutional commitment.

Norwegian cryptocurrency investment company Arcane Crypto is intending to go public through a reverse takeover of Swedish firm Vertical Ventures, which is listed on Nasdaq First North. While not exactly a large market, it is seen as a way to get some liquidity and also market valuation experience, and as a stepping stone towards a listing on the main market.

A bitcoin exchange-traded product (ETP) taken care of by 21Shares, a Swiss-based item carrier formerly referred to as Amun, has noted on Xetra, Deutsche Boerse’s digital trading venue. TAKEAWAY: As with ETC Group’s bitcoin ETP last month, this will increase conventional accessibility to crypto financial investment. Xetra is one of the biggest digital trading platforms in Europe, as well as has a lot more international reach than SIX Swiss Exchange and Boerse Stuttgart, the other exchanges on which 21Shares has listed crypto items.

Podcasts worth paying attention to:.

Join us at a complimentary introductory webinar on crucial bitcoin metrics!

Register to receive Crypto Long & Short in your inbox, every Sunday.

Disclosure.

The leader in blockchain information, CoinDesk is a media electrical outlet that pursues the highest possible journalistic criteria and also abides by a rigorous collection of editorial plans. CoinDesk is an independent operating subsidiary of Digital Currency Group, which purchases cryptocurrencies and blockchain start-ups.

We’re excited about this because it represents a maturation of the crypto markets and also removes one of the considerable obstacles standing in between establishments as well as crypto investment: the structural ineffectiveness of funding. Crypto markets are likely to increasingly look like conventional markets. Bitcoin may seem to be extra unpredictable than conventional assets yet in crypto markets it is thought about relatively secure compared to various other cryptocurrencies.

Crypto expert as well as investor Chris Burniske hypothesized that, offered the ruthless rise of equity markets, we might well soon see a large crypto business go public– as well as that this would certainly be a catalyst for higher mainstream interest in the sector. While not specifically a large market, it is seen as a method to get some liquidity and market evaluation experience, and also as a stepping rock in the direction of a listing on the main market.