Bitcoin fell listed below $10,000 this weekend also as a majority of crypto warriors on Twitter were anticipating a supersonic price boom in the direction of $13,000, $14,000, $15,000, $20,000, and also beyond.

That was apparent for most of us. Bitcoin had every ingredient to dispense a tasty bull run.

A reserve bank that committed to increase inflation rates past its normal targets. A myriad of experts as well as strategists that suggested an extended duration of lower rates of interest. As well as a market that was seeking to draw even more United States bucks as they came to life in the form of government-sponsored help.

Yet despite every favorable fundamental, Bitcoin slapped its $10,500-something top as well as increased atop bears to fall below $10,000 this Saturday. Investors sold one of the most bullish asset of this year. However why?

Bitcoin versus US Economy Recovery

There are no exact reasons. Yet there are concepts that border the solution. One of them is the US economy itself. Last week, Uncle Sam released two data: one concerning the production, as well as the other, joblessness.

Both resembled two-scoop gelato for financiers that desired some sweet updates, after all. The ISM Manufacturing PMI rose from 54.2 to 56 in August, the highest possible reading considering that January 2019. The labor market healed as the number of people gathering unemployment benefits decreased by 1.24 million to regarding 13.3 million for the week finished Aug. 22.

The news kicked back at the very least those who were intending to infuse even more liquidity right into the US economy to assist those who lost houses as well as work. That recommended that there would now be lesser-than-expected United States bucks in the marketplace. Subsequently, there will be less cash available to continue an otherwise inflated Bitcoin, stock, and also gold market.

The outcome was a stronger cash. The US dollar index, which matches the buck against a collection of foreign currencies, rebounded 0.73 percent recently. Earlier prior to, the index had plunged to its 27-month reduced.

DXY’s rebound drinks risk-on and risk-off markets.

At the same time, the US bond returns increased, recommending that there were currently better returns available in the bond market. Additionally, Treasuries were less expensive to acquire.

All that took place due to the fact that capitalists believed there is still a possibility of a full-fledged economic recovery.

A Sandbox-Like Experiment

The recently’s Bitcoin dive versus an enhancing financial outlook in the United States works as a reminder that the cryptocurrency is allergic to good macroeconomic occasions.

It resembles a sandbox experiment that shows how Bitcoin investors sell-off their holdings for near-term earnings regardless of a long-term rising cost of living overview.

They often tend to neglect that the federal deficit spending may go beyond $3.3 tn by the end of this year. They also disregard that the United States national debt might currently elude the dimension of its economy, with its debt-to-GDP anticipating to exceed 107 percent by 2023.

All that would certainly require more stimulation measures from the top brass. It indicates the injection of even more United States dollars into the economic climate– an inflationary workout, on the whole. However Bitcoin still falls below $10,000, possibly as a result of a small number of weak however significant hands in search of short-term gains.

That however advises of their inherent demand to have cash money initially, Bitcoin later. Cash is something that all of us require to purchase things, be it an aircraft or a safety-pin. Regardless of how much the US dollar drops, it has energy.

Bitcoin works as something that safeguards individuals from a diminishing US buck. It is kind of a saving deposit that promises to hold your dollars for a longer timeframe and return better returns for doing it.

That makes Bitcoin a supply-and-demand game. Its rate goes greater as long as there is money to enter its market by means of “whatever it takes” plans. Yet it also risks diving more challenging than ever whenever demand changes to cash money.

The mainstream economic market is the most effective instance to describe that. Countries like Japan, South Korea, and Taiwan in the 80s and also Thailand, Malaysia, the Philippines, and also Indonesia in the 90s knowledgeable possession bubbles. However after that it complied with a long period of drawbacks.

As CoinStats likewise talked about earlier, China’s CSI 300 likewise pumped greater after the 2008 monetary crisis after their reserve bank stepped in with huge stimulation help. The rally fizzled in 2015. Today, the index rests a tenth below its all-time high.

Since of the capital reallocations that are always taking place around us, it is. People market one possession for one more based upon their personalized requirements. Someday, they might require Bitcoin. On the other, they could desire to market the token for Yuan so they might get a Beijing genuine estate with the money.

What is Bitcoin’s Worth Then?

Not a million bucks. The cryptocurrency is worth more than where it trading presently.

In one facet, the opportunity of disappointing Bitcoin performance over the coming months can not be disregarded, offered exactly how quickly it has actually rallied because March 2020– 161 percent, at the time of this writing.

Bitcoin slides towards $10,000.

Investors have actually pumped BTC/USD based on a lot of assumptions. And the market requires a lot more capitalists to make sure that the benefit maintains. Yet given the underlying volatility risks, regulatory uncertainty, and concerns of cost adjustment, not all individuals have the stomach to ride the Bitcoin rollercoaster.

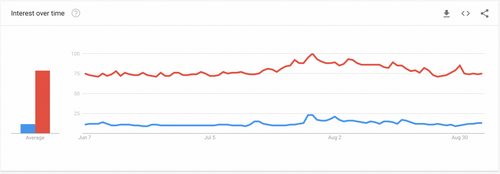

That displays in the Google Trends result for the keyword ‘Bitcoin.’ Few individuals are looking for the cryptocurrency even in the middle of one of the scariest financial crisis. Gold is doing better there.

Gold-Bitcoin pattern contrast over the last 90 days.

In various other aspects, Bitcoin requires even more time to establish itself as a hedging rival to established possessions like gold. Yet do not allow it mislead you with million-dollar cost prediction write-ups; even the precious metal, versus the constantly compromising fiat money, had logged bear cycles.

Bitcoin is no less than any other possession if one obtains the “cutting edge” tag.

So be cautious if BTC/USD falls back to $6,000 on a more powerful buck sentiment, a working coronavirus vaccine, and a V-shaped economic recuperation. However stay with it if you remain in for a longer timeframe so to ensure that you beat rising cost of living and fiat devaluation with one accomplishment.

Believe that Bitcoin’s appreciation has to with the dollar’s demand, not worth. Also gold bulls had to wait 9 years to reclaim their top degrees.

Given that you’re below, do check out the CoinStats cryptocurrency profile administration application to handle all your crypto investors right from one location.

Regardless of every favorable essential, Bitcoin put its $10,500-something top and increased atop bears to fall listed below $10,000 this Saturday. In turn, there will be less cash available to continue an or else pumped up Bitcoin, supply, and gold market.

Bitcoin still drops below $10,000, probably because of a tiny number of prominent however weak hands in search of short-term gains.

One day, they might require Bitcoin. Provided the underlying volatility risks, governing uncertainty, and fears of rate control, not all people have the tummy to ride the Bitcoin rollercoaster.