That consists of bitcoin, which shot up some 13% on Monday for its greatest gain in practically 3 months. Rates rose previous levels reached in February, prior to the pandemic-induced sell-off, getting to a new 2020 high of $11,180.

As the united state dollar’s worth slides, prices are instantly climbing for nearly whatever valued in dollars.

Joe DiPasquale, CEO of the cryptocurrency hedge fund BitBull Capital, informed First Mover in an e-mail that the current go up appeared “in sync” with gold’s climb in current days to a new document. Bitcoin is seen by numerous digital-asset analysts as a hedge against rising cost of living and also currency reduction, similar to the means capitalists in typical markets have actually traditionally utilized gold.

” Bitcoin sprung right into action,” DiPasquale claimed.

Bitcoin Price Chart

It’s a remarkable growth in the bitcoin market, where capitalists, as recently as last week, were despairing that the oldest and largest cryptocurrency had been stuck in an array between $9,000 as well as $10,000 for the past two months.

So for bitcoin bulls, the jolt out of the doldrums was welcome, specifically when the price increased, not down. The day’s gain came on strong trading quantity, with degrees not seen because early June.

” The pattern is clear as well as we are headed higher,” claimed Jack Tan, of Taiwan-based measurable trading firm Kronos Research.

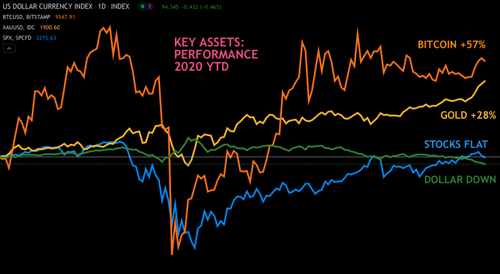

Bitcoin is now up 57% year to day, greater than double the 28% gain this year for gold, which climbed in current days to a record. The Standard & Poor’s 500 Index of huge U.S. supplies, meanwhile, is about flat for the year.

” Given gold has simply set a brand-new all-time high, and also with bitcoin’s correlation to stocks breaking down while being replaced by a strong connection to gold, we imagine additional examinations to the benefit this coming week,” the cryptocurrency-trading company Diginex wrote in a daily market record.

Year-to-date performance of bitcoin versus other essential properties

The U.S. Dollar Currency Index, a scale of the greenback’s worth versus other major currencies like the euro and also yen, has fallen for seven straight sessions; the Wall Street firm Goldman Sachs forecasts the buck could lose an additional 5% over the next 12 months.

” The U.S. buck is wearing down quickly, as well as individuals are starting to observe,” wrote Mati Greenspan, owner of the cryptocurrency as well as foreign-exchange study firm Quantum Economics, in his day-to-day email. “It’s simple to see that people are dumping the dollar as rapid as they can.”

That’s excellent for bitcoin as well as gold: As the Wall Street Journal put it Monday, a weakening dollar “mechanically raises the prices of the commodities invoiced in paper money.”

Financiers appear worried the global financial recovery is failing, with situations on the surge and a fatality toll around the world that simply passed 650,000. In the U.S. Congress, Senate Republicans proposed a $1 trillion relief package adhering to arrangements with President Donald Trump, but that amount drops far short of a Democrat-led prepare for $3.5 trillion in stimulus.

Jim Reid, strategist for the German lender Deutsche Bank, wrote in a report that the Federal Reserve, which has currently broadened its balance sheet this year by about $3 trillion to around $7 trillion, might require to pump an additional $12 trillion over the following few years.

The Federal Reserve is set up to satisfy today in closed-door conversations, with a statement due late Wednesday. With rates of interest already close to zero, no significant policy changes are anticipated, yet the cryptocurrency mutual fund Arca kept in mind Monday that a sell-off in the U.S. stock exchange may prompt the U.S. central bank to respond.

A record on Thursday is anticipated to reveal that U.S. gdp decreased throughout the second quarter by a shocking 35% on an annualized basis.

With so much delicacy in the economy, as well as points not boosting quickly, “the moral danger is currently so high that the securities market hardly even needs to blink,” Arca composed.

For bitcoin, according to Arca, “the outbreak was simply a matter of time.”

Bitcoin watch

BTC: Price: $10,773 ( BPI)|24-Hr High: $11,395|24-Hr Low: $10,215.

Trend: Bitcoin is observing a low-volume technical pullback on Tuesday.

The biggest cryptocurrency by market value is currently trading near $10,850– down over 4% from the 11-month high of $11,394 gotten to on Monday.

The drop in rate recommends bitcoin might be miscalculated. The 14-day loved one toughness index jumped to 82 as costs rose 11% on Monday. An above-70 analysis shows overbought conditions– meaning excessive demand has pushed rates unjustifiably high.

The pullback might be extended even more, as the 14-day RSI is still hovering above 70. Additionally, the RSI on the hourly graph has actually dropped right into bearish area below 50. That stated, the favorable prejudice might be invalidated if costs end up below $10,500 (the February high) at the UTC market close.

That looks unlikely, as the decline from multi-month highs observed until now today is accompanied by a slide in trading volumes (over right). A low-volume pullback is usually short-term.

Besides, some experts are convinced that Monday’s favorable move has placed bitcoin on the path towards record highs.” [Monday’s] daily close is outstanding and could effectively appear like April 2019’s $1k candle light that finished the bearish market and fueled a rally to $13,000. Just this time, the rally must cause new all-time-high for BTC,” prominent analyst Josh Rager tweeted very early Tuesday.

The 14-day relative toughness index leapt to 82 as rates rose 11% on Monday. An above-70 reading suggests overbought problems– implying excessive need has pushed prices unjustifiably high.

The pullback may be expanded further, as the 14-day RSI is still floating over 70. That claimed, the bullish bias might be invalidated if costs complete listed below $10,500 (the February high) at the UTC market close.

Just this time, the rally should lead to brand-new all-time-high for BTC,” prominent analyst Josh Rager tweeted early Tuesday.