Just One Bull for Bitcoin: Stimulus. Meanwhile, some investors are selling stocks in anticipation that there won’t be a stimulus up until the US presidential election on November 3.

At the same time, those with a long-term outlook buy the dips, thereby keeping the market within a strict trading range.

Bitcoin traders are showing the same bias. Despite a sequence of good news that concerns its mainstream adoption – such as hundreds of millions of dollars of combined investments from Square, MicroStrategy, and other mainstream firms, the cryptocurrency market’s most clear bullish bias remain the STIMULUS DEAL.

So does it matter what the third-quarter earnings are? Not entirely. The US central bank and government have created artificial inflation in the risk-on markets with their unprecedented expansionary policies.

Those with a more robust risk appetite would likely hold Bitcoin through the choppy storm ahead. Meanwhile, those looking to secure short-term gains would keep pushing its price towards $10,000 – or lower.

Where do you stand? Tell us in the comment box below.

The dilemma was the same at the beginning of July 2020: could or could not Wall Street earnings influence the Bitcoin price trend? Entering October 2020, the market has some clues about it.

But before discussing that, let’s focus on one of the articles we published ahead of the second-quarter earnings in July.

Titled “BITCOIN INVESTORS SHOULD PREPARE FOR A STORMY SECOND HALF OF 2020,” the piece discussed our fears of a significant downside correction in the Bitcoin market should overvalued equities correct. And we were somewhat right.

We had anticipated a chain of events that goes in the order as follows.

The US government stimulus of $2 trillion expires. The market runs out of liquidity. Investors start seeking cash, so they decide to sell whatever asset that appears profitable to them. They dump stocks of companies with low Q2 earnings and higher equity value.

Meanwhile, those with exposure in Bitcoin also sell their holdings for cash; the stock market indexes go down; Bitcoin falls in tandem.

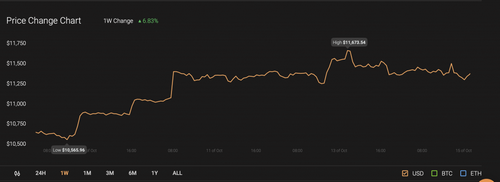

The benchmark cryptocurrency started correcting almost a month after we published the article mentioned above. On August 17, it topped for the year near $12,500. By September 8, it was trading for as low as $9,819.

Strong Supports

But as we said, we were SOMEWHAT right – not entirely. We did not expect Bitcoin to hold the $10,000-level as support firmly. But it did anyway. The result was a strong rebound towards $11,700 just this week, albeit amid choppy trading.

Similarly, the US stocks underwent massive downside corrections led by the tech stocks. But they managed to hold above crucial support levels on the Federal Reserve’s vows to keep interest rate near zero up until 2023, keep buying government bonds infinitely and raise its long-term inflation target above the 2 percent benchmark.

Investors understood they had nowhere else to go. If they treated the US dollar as their safe-haven, an additional stimulus would pose risks to their outlook. If they remained glued to the US bonds market, the poor yields led by lower lending rates would have made it a wrong choice.

That caused the so-called TINA effect, a backronym for There-Is-No-Alternative. Investors increased their exposure to assets that were riskier than the US dollar and bonds. That included stocks that rose despite their companies’ inadequate revenues.

With that came the third-quarter earnings season this week. Yes, the US equities remain overvalued. Wall Street analyst FactSet reports that many firms have even refused to publish their financial records. But still, investors are bullish on stocks.

The reason is the same: investors expect the US Congress to release the second stimulus package. The Democrats and the Republicans have already delayed the aid for months over its size. The former wants $2.3 trillion for the American people, while the latter has refused to push it anywhere above $1.6 trillion.